Get Low Interest Loan Offers Online, Fast & Easy

Apply for a loan at eCompareMo and get several offers that you can compare, all online. See offers with the lowest interest rates and the longest payment terms.

The widest range of consumer loan products online

With eCompareMo, you can compare loan offers from trusted loan companies nationwide with low interest rates.

eCompareMo takes it up a notch by handling the application of a loan for you, helping you save even more time, effort, and money. Our in-house banking experts are here to provide tips on how to make the entire process run smoother.

Our mission is to help you achieve financial freedom by offering various loan products that's accessible to everyone. Aside from loan comparison services, we also provide insightful and informative content that will help you become more financially literate.

Find the best consumer loan product that suits you

Whether you need home loans, auto loans, and personal loans, you can compare offers easily and apply online.

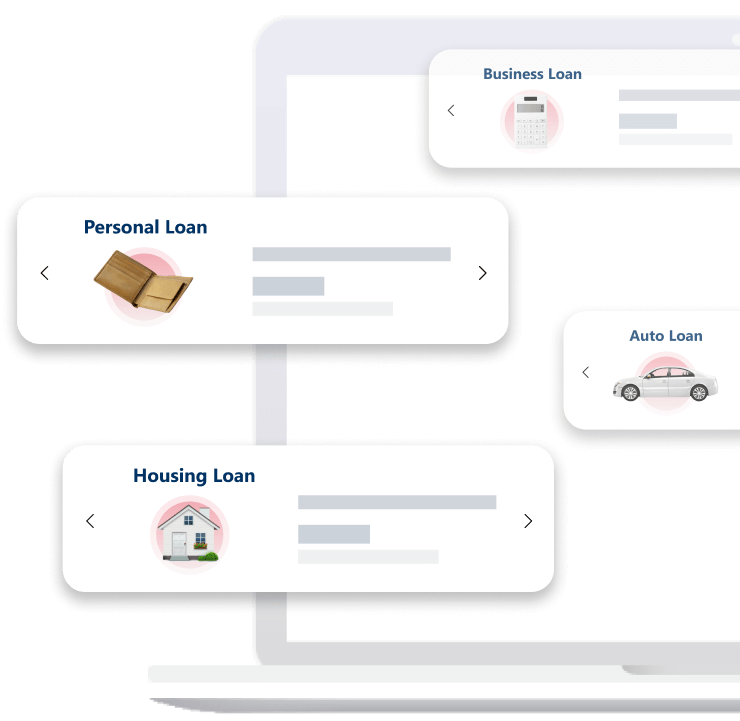

Choose from loan products available

Do you need a loan for personal use, to buy a car, or to build that dream house? We have the right loan for you.

Personal Loan

Personal loans will give you instant capability to make payments for tuition, travel, and everything in between.

Personal Loan

Auto Loan

Whether you’re looking for a brand new or used car, there is an auto loan that’s right for you at eCompareMo.

Auto Loan

Housing Loan

Turning your dream home into a reality can be a daunting process--but we can make it easier for you through these home loans.

Housing Loan

Business Loans

Fund your business’ expansion with a boost in capital from a business loan at eCompareMo.

Business Loans

Personal Loan Calculator

Find out how much you can borrow from trusted banks and lending companies nationwide.

Personal Loan Calculator

Housing Loan Calculator

Planning to buy a new home? See what fits in your budget with this housing loan calculator

Housing Loan CalculatorThe best lending companies & banks in the Philippines

eCompareMo is partnered with the best banks & lending companies in the Philippines with offers that suit you.

-

-

BDO Bank

BDO Bank

-

Bank of the Philippine Islands

Bank of the Philippine Islands

-

-

Chinatrust Philippines Commercial Bank

Chinatrust Philippines Commercial Bank

-

EastWest Bank

EastWest Bank

-

-

HSBC Bank

HSBC Bank

-

-

-

Metrobank

Metrobank

-

The Philippine Bank of Communications (PBCOM)

The Philippine Bank of Communications (PBCOM)

-

Rizal Commercial Banking Corporation (RCBC)

Rizal Commercial Banking Corporation (RCBC)

-

Security Bank

Security Bank

-

Unionbank

Unionbank

-

-

Know More About Loans

Do you want to learn more about how to get approved for a loan? Check out our guides.

How To Get Approved for Personal Loan In The Philippines?

Here are some useful insights that might help you get approved on your next loan.

Get approved for a personal loan

Key points you need to know about Personal Loans

Know all the important things about a personal loan

Be informed about personal loans here

Types of Personal Loan

Read the following loan types to know which personal loan suits your interest best.

Secured or Unsecured loans?Every loan offer you need is here.

Navigate through our various loan products that matches your need.