How Your Smartphone Can Help You Save Money And Get Out Of Debt This 2020

6 min readSci-fi books from back in the day would have you in awe of the technological reachings of the year 2020.

For instance, Back to the Future brought us their amazing time travel story dated in 2015, which of course, was nowhere near our reality.

A time machine may still be an impossible reality in this day and age no matter how cool 2020 sounds like (and may it be so forever, just saying), but we are all still living at a time of great technological advancements. Twenty years ago, it would be hard to imagine all the freedom, knowledge, and convenience that we are enjoying now.

Given all this, why aren’t more people obsessed with learning about growth and personal finance in as much as we can, given the tools that we have? Technology is a double-edged sword no doubt, and it’s really up to how the person uses them.

This 2020, we can limit our time getting mindlessly sucked in things as social media browsing, and start making use of the technology that we have, in order to earn and save money, and get out of debt this 2020.

Let’s start with your smartphone.

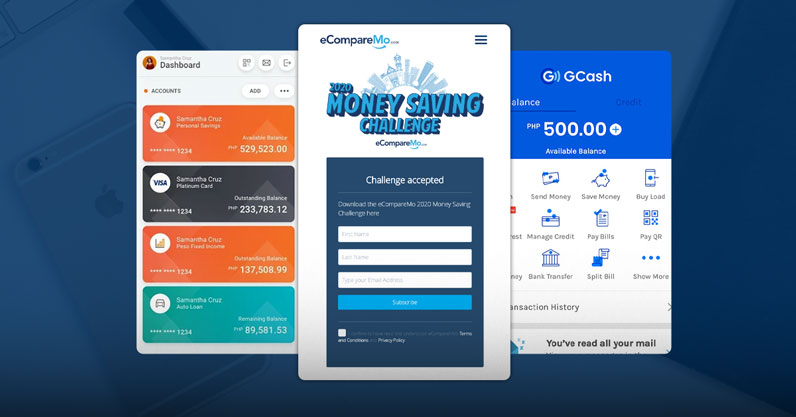

Savings/money-tracking apps

1. Your bank’s mobile banking app.

About the easiest of them all, you can monitor your accounts, whether it be savings, checking, and credit card.

It allows you to do free money transfers not just to your own bank, but with other banks, too. You can also buy mobile load and pay your utility bills straight from your bank’s app.

If your credit card is also from the same issuer, it’s easier to make your timely payments. You can even set autopayments!

2. Timecost

Available only in iOS as of writing, this is a unique (and free!) money-growing app. It keeps you in check and on track with your financial goals, as it helps you do the math for how much you’re paid per work hour/minute/second.

And because of this, you’ll know how much work you need to put in to buy certain thing/s on your wishlist and track your progress. Talk about delayed gratification!

If you need to, you can set reminders for your monthly savings, and keep the history of your savings in the app or in your cloud, for backup.

3. GCash

If you’re still having second thoughts in using this virtual wallet app, know that it’s so easy to get started and verified with GCash!

It allows you to send money just by typing in your recipient’s phone number. Send remittance to other banks, or other money remittance centers just by topping up your Gcash balance, and sending it through banks online and for free! It also comes with gift cards and referral rewards.

4. Bluecoins Finance

There are already a lot of complicated things in life, and saving money doesn’t have to be one of them, especially when you’re just getting the hang of it.

Bluecoins promises a simple finance app that tracks your expenses, bank accounts, and debts. It then creates reports and charts from all the data you’ve entered. So, even if you’re not the super-organized Type A kind of person, this app will do the tracking and organizing for you.

5. Simple Budget

As the name suggests, if you want an easy way to set your finances right, this one’s got you.

The Simple Budget app allows you to budget by setting a budget inside envelopes. This way, you’ll easily track and see the status of your budget and decide on what to do with what’s left of your funds (save it!).

(Read: 4 Budgeting Apps Every Financially Savvy Pinoy Must Have)

Money-saving apps for motorists

All vehicle owners know that one of the biggest drains on your budget is the cost of fuel. With these apps for motorists, which connect them to loyalty programs of different fuel companies, you get access to promos and offers that can help ease the burden of fuel costs.

1. Petron

From allowing you to monitor your fuel spend to locating the nearest gas stations, the Petron app makes fueling up convenient.

It also lets you in on the latest and exclusive Petron promos. Monitor your Petron loyalty card points in this app and have them exchanged for freebies and discounts.

This app also details the services that Petron loyalty cardholders can avail, such as free towing, roadside assistance, and personal accident insurance.

2. Shell Motorist App

Avail of special offers, loyalty card points balance and points redemptions. Locate nearby stores when you’re traveling around. In other countries such as Germany, UK, Turkey, and India, the Shell Motorist App allows for mobile payments when you refuel.

(Read: Fuel-Saving Tips: How To Save Gas On Manual And Automatic Cars)

Money-saving challenges

The new year brought in reminders of effective money saving challenges. Some brought new, and even cheeky ones, too. And as always, you just have to choose which one you think would best stick with you. The key here is commitment—no hugot intended.

1. The eCompareMo 2020 Money Saving Challenge

Our mission of guiding Filipinos to wiser and wealthier lives has gotten us this far. And to start the year, we’re here to guide you with our very own Money Saving Challenge.

2. Chinkee Tan’s Money Saving Challenge

Made for couples or ipon (savings) partners, this one brings an added and practical twist to the usual money saving challenges we know. It’s categorized into types of savings such as Monthsary Savings, Travel Savings, Payday Savings, Future and Home Savings, and Optional Savings.

3. The Classic 52-Week Money Saving Challenge

There’s lots of guides and images online on how to do it right, but put simply, the excel sheet shows the amount you should save weekly.

The amount to save grows incrementally as the year comes to a close, which, if one is truly committed, can save up to around P70,000 by the end of the year. If you think you can commit to larger amounts, then you can set your own weekly savings amount according to your monthly income.

(Read: Four Great Productivity Methods To Try For A New, More Productive You)

Financial knowledge at your fingertips

1. YouTube

The University of Youtube, as it’s jokingly called by people who have made full use of it, is one of the biggest and most popular video platforms in the world. Most everything you need to know is right there, waiting for you to explore and discover.

You can start with Dave Ramsey, dubbed as “America’s trusted voice on money†on his The Dave Ramsey Show, which answers everyday money questions from real people.

2. Podcasts

Whether you’re looking on Youtube, Spotify, Soundcloud, or other podcasting platforms, seek and you shall find a treasure trove of money and finance experts.

Look for the ones that give free and valuable advice on how to get your finances in order.

Start with the Tim Ferriss Show personal finance episodes where he talks to experts on the topic. With this podcast, you’re sure to get hooked and go further down the rabbit hole of not just money talks, but personal growth as well.

3. Google

When you’re tired of mindlessly scrolling through social media, you can start searching and learning about personal finance topics that interest you. It’s all online, and you will be amazed at how much you’ll learn.

Maybe you can look up online personal finance books while you’re in there, too, if that’s what you think could really get you started.