A Guide To Pag-IBIG Fund Registration, Claims, and Verification

16 min readYou may notice that every month there are miscellaneous fees deducted from your monthly paycheck. One of these fees is your Pag-IBIG Fund contribution.

Pag-IBIG is a mandatory government contribution. This means employees and employers are required to contribute to Pag-IBIG.

- Introduction to the Pag-IBIG Fund

- How to register for Pag-IBIG as a Voluntary Membership (application & requirements)

- How to join Pag-IBIG as a Voluntary Member

- Pag-IBIG fund benefits and programs

- The Pag-IBIG loyalty card

- Pag-IBIG Contribution Table

- How to compute for your Pag-IBIG Fund monthly contribution

- How to check and verify your Pag-IBIG Fund contribution

- Pag-IBIG online services

But what is Pag-IBIG really and where do your monthly contributions go?

Pag-IBIG stands for “PAGtutulungan sa kinabukasan: Ikaw, Bangko, Industriya at Gobyerno.†It’s a saving scheme project of the government for the people in partnership with various banks and industries.

The Pag-IBIG fund was established to be “an answer to the need for a national savings program and an affordable shelter financing for the Filipino worker.â€

In a nutshell, you contribute to Pag-IBIG and this allows you to eventually take out some of the money in the form of government loans.

The most common type of Pag-IBIG loans are meant to help you purchase a residence, but there are other acceptable loan purposes as well.

In this article, we will be providing you with all the information that you need regarding Pag-IBIG Fund. From membership registration to the different kinds of loans available and on how you can claim your well-deserved benefits.

Learn more about this program, maximize your privileges as contributors and make your dream of providing your family your dream home come true.

Introduction to the Pag-IBIG Fund

First established in 1978 through the enactment of Presidential Decree No. 1530, Pag-IBIG Fund was created primarily to address issues regarding affordable housing for Filipinos.

The Pag-IBIG Fund, which is also known as the Home Development Mutual Fund (HDMF) acts as the government’s response towards the issues on the provision of housing and financing schemes which aims to help ordinary Filipinos afford their own houses.

During the Arroyo administration in 2009, Republic Act No. 9679 or the Home Development Mutual Fund Law of 2009 was enacted essentially to give the HDMF the authority and privileges that would not only make it an avenue to financially assist its members, but also the opportunities to maximize the use of its funds.

The HDMF has three main functions all intended to help finance not only housing needs, but also other immediate and long-term financial needs. These are insurance, loans and savings. Let us discuss the purpose of each.

1. Insurance

There are various Non-Life Insurance Programs made available by the HDMF to their members which allows them to secure their hard-earned properties from the risks that may compromise their homes.

One of such is the Mortgage Redemption Insurance Program. This insurance program functions as a provider of amortization support of up to P500,000, or a 20% refund in case of the member’s inability to pay the remaining amortization payments due to death or permanent disability. This type of insurance is subjected to the underlying terms and conditions followed by the HDMF.

Another Non-Life Insurance program available is the Fire and Allied Perils Insurance Program. This insures properties under Pag-IBIG loans from certain risks like earthquake, fire, flooding, and other natural disasters and accidents.

2. Loans

Pag-IBIG Fund benefits will not be complete without its housing loan programs. There are several loan options available that will cater each of their member’s specific needs. There are 3 types of loans provided by the HDMF. These are:

a. Calamity Loans

Calamity Loans are schemes that allow members to borrow loans due to the occurrence of calamities and other disasters that may have affected them.

Members may take out up to 80% of their total accumulated value within 90 days from the declaration of a state of calamity. This type of loan can still be shelled out by members even if they still have an outstanding loan but is subject to certain restrictions especially regarding the amount of calamity loan they may avail of.

b. Housing Loans

HDMF’s Regular Housing Loans (RHL) and Affordable Housing Program (AHP) both allow its eligible members to borrow money from them for purposes involving the purchase of land or a residential building and unit.

This is also applicable to members shelling out money for improvement or renovation of their existing homes, or even recapitalizing their existing housing loans.

Members availing the AHP may borrow up to P750,000 depending on several factors. On the other hand, members who will be availing of the RHL may take out up to P6M but is subjected to certain conditions.

c. Multi-Purpose Loans

Pag-IBIG Fund’s Multi-Purpose Loans are cash loans intended for various needs including tuition fees or other education expenses, car repair, payment of utilities and credit card bills, vacation or travel, minor home improvements or upgrades, livelihood or additional capital in a small business, and any other immediate needs.

Members can borrow up to 80% of his/her Total Accumulated Value or the difference between 80% of the member’s TAV and the outstanding balance from his/her previous loans.

d. Savings

The Pag-IBIG Fund Savings Program is a fast and affordable way for members to save for their future. It is a form of investment from which qualified members can apply for short-term loans for their immediate needs, and a housing loan with easy payment terms and low interest rates.

Monthly provident savings can be as low as P100, however, members may choose to increase their monthly savings for higher Total Accumulated Value, as well as higher Short-Term Loans entitlement.

How to register for Pag-IBIG membership (application & requirements)

There are two types of PAG-IBIG members: mandatory members and voluntary members.

Mandatory members refer to those individuals whose membership were made mandatory by the enactment of Republic Act No. 9679 in 2009. Voluntary members, on the other hand, are those individuals whose membership were not mandated by the said law but are still interested in availing of the benefits attached to such membership.

The law provides for certain qualifications for each type of member. However, these qualifications may be said to be strictly applied to mandatory members, considering that their mere inclusion in the enumerated list under the law qualifies and necessarily includes them within the coverage of the HDMF, thereby attaching unto them the appropriate monthly contributions, as well as the benefits.

If you are curious as to how you can be a contributing member of Pag-IBIG Fund, there are 2 ways on how you can do it. One is through their online portal and the other one is through their main and satellite branches.

Voluntary members

Self-employed or voluntary are individuals at least 18 years old, but not over 65 years old who are not employed in a company, those individuals who have their own businesses etc., and other qualifications stated below.

Their registration, obviously, necessitates compliance with the same rules and regulations for all PAG-IBIG members, as well as with the eligibility requirements for availing of the loans and benefits offered by the HDMF. In this light, the following people may be allowed to apply as voluntary members:

Qualifications:

- Non-working spouses whose employed spouses are registered members and consents to the membership of the former.

- Filipino employees of foreign states or international organizations.

- Employees of companies that are granted waivers or privileges purporting to suspend the coverage of the fund.

- Leaders and members of religious groups.

- A recently unemployed member who would like to continue paying his or her personal contributions.

- Public Officials not covered by the GSIS, such as Barangay officials.

- Other earning individuals and groups, as may be determined by the Board.

(Read: Beyond Pensions And Loans: 3 Government Savings Programs To Check Out)

Requirements:

Here are the respective requirements for different categories of Individual Voluntary Members.

1.Self-Paying Employee (Waived Company)

You may be employed by one or more companies, but for some reasons, you choose to pay your Pag-IBIG contributions by yourself without their aid.

- Certificate of Employment and Compensation

- Latest Pay Slip

- Company ID

2. Self – Employed

Freelancers, professionals, consultants and owners of small businesses belong to this category.

- Latest Income Tax Return (ITR) with Financial Statement of the previous year certified by a CPA

- Certificate of Remittance/ESAV (for old members)

- 2pcs. 1×1 ID pictures

- SEC or DTI Registration (should be under the member’s name)

- Business Permit or Mayor’s Permit

3. Franchise Holders or Operators

- Franchise Permit (under the member’s name)

- Official Receipt or Car Registration (under member’s name)

- Latest ITR (previous year)

- 2pcs. 1×1 ID pictures

- Certificate of Remittance or ESAV

4. Self-Employed Professionals

These are government licensed professionals practicing their expertise.

- PRC / BAR License

- Latest ITR (previous year)

- Certificate of Remittance or ESAV (for old members)

- 2pcs. 1×1 ID pictures

5. Unemployed Spouse

Yes, if you are unemployed you may still qualify provided your spouse is employed and a Pag-IBIG member.

- Written consent from member-working spouse

- Certificate of Employment and Compensation of member-working spouse

- Affidavit of Unemployment

6. Member-Spouse with Business

This is similar to an unemployed spouse, but in this case, the spouse is in business.

- Latest ITR

- Written consent from member-employed/working spouse

- Certificate of Employment and Compensation of member-working spouse (notarized)

- Affidavit of Unemployment

- 2pcs. 1×1 ID pictures

- ITR (previous year)

- Business Permit or Mayor’s Permit

- SEC or DTI Registration

7. Unemployed (reactivating member

- Affidavit of Unemployment

How to join Pag-IBIG as a Voluntary Member

Step 1. Accomplish and submit two (2) copies of the MDF and all required supporting documents to the Marketing and Enforcement Division of the concerned Pag-IBIG branch office (bring all originals for authentication).

Step 2. Secure a Payment Order Form (POF) from the Marketing and Enforcement Division, and then proceed to the Cash Division for payment of initial Membership Contributions (MC).

Step 3. Present all verified/stamped documents to the Marketing and Enforcement Division.

Step 4. Secure a Payment Order Form before proceeding to Cash Division for payment of contribution.

Employed or mandatory members

Mandatory members are employees who must be working in a private company and covered with by the Social Security System (SSS). Private employees must not be older than 60 years old or those individuals who possess the qualifications stated below.

In most cases, you don’t even have to bother about it since your employer will file your membership to the Pag-IBIG Fund and remit your contributions on your behalf but if your company, you can always take control and take the necessary steps yourself. This is especially true if you are considering getting a housing loan anytime soon.

Qualifications:

Employees who are ought to be covered by SSS, including but not limited to:

- Private employees not over 60 years old;

- Household helpers whose monthly earnings are at least Php 1,000;

- Filipino seafarers, upon entering into a contract of employment with the manning agency and the foreign shipowner as employer

- Self-employed individuals not over 60 years old, with monthly earnings of at least Php 1,000; and

- Expatriates who are not over 60 years old and are compulsory members of the SSS.

- Employees who are mandatory members of the GSIS, including members of the Judiciary and the Constitutional Commissions (COMELEC, COA, CSC).

- Uniformed members of the AFP, BFP, BJMP, and PNP.

- Filipinos employed by foreign-based employers, whether deployed in the Philippines or abroad.

Applying for Pag-IBIG if you are currently employed

Step 1. Locate the Pag-IBIG branch that is nearest to your place of work. Usually, this is the regional office of Pag-IBIG Fund.

Step 2. Proceed to the Marketing and Enforcement Division of the concerned branch.

Step 3. Request for a copy of the Membership Registration/Remittance Form (MRRF).

Step 4. Accomplish and submit two copies of the MRRF together with the following supporting documents to the Marketing and Enforcement Division: • Members’ Data Form (MDF) • Certificate of SSS Coverage and Compliance (for the current year), if private employer • GSIS Certificate of Membership, if government employer

OFW Membership

OFWs are required to contribute to Pag-IBIG Fund to take advantages of the benefits the fund can provide to them. Let’s take a closer look at how an OFW can apply to be a Pag-IBIG fund member.

Requirements:

- Latest Contract of Employment

- Passport or any valid ID / POEA License

- Latest and valid Contract of Employment (with POEA original stamp)

- Certificate of Remittance or ESAV

- 2pcs. 1×1 ID pictures

- Special Power of Attorney (SPA), in case a representative shall submit the documents and pay the member’s contributions

Applying for Membership:

Step 1. Fully accomplish a Pag IBIG Member’s Data Form.

Step 2. Visit the Members Services Office or Branch nearest you and submit 2 copies of duly accomplished Member’s Data Form, along with the other supporting documents required for each individual voluntary member to the branch’s Marketing and Enforcement Division.

Step 3. Procure a Payment Order Form and head to the Cash Division for payment of your contributions.

Step 4. Upon payment, head to the Marketing and Enforcement Division and present your verified supporting documents.

Member registration may be done in person or through the available online channels. Applicants registering in person would have to take into account several factors that may make the process easier.

First, it would be important for applicants to take note of the office hours of Members Service Offices or Branches on regular days. These offices are expected to be open for transactions from 8 o’clock in the morning to 5 o’clock in the afternoon, with no noon breaks.

It is also important to note that no processing fee has to be paid for registration as members. It would be best to avoid fixers who may promise faster transaction times for handling fees as this practice is frowned upon and highly discouraged.

Pag-IBIG fund benefits and programs

As a contributing member of the Pag-IBIG Fund, you can avail a number of benefits and programs offered by them. Here are some:

1. Multipurpose loan

This loan provides financial assistance to cater to urgent financial needs of members. These needs can include matters related to the establishment of a home or minor renovations or repairs of the home. They can also include medical, educational, and livelihood expenses that a member might have.

2. Housing loan

This loan allows members to borrow money from the fund for the purchase of property or for the renovation or improvement of existing properties. Qualified members can borrow up to P6M for a loan term of up to 30 years. The loan interest will solely depend on the pricing framework set by Pag-IBIG and on the re-pricing period chosen by the member.

3. Pag-IBIG acquired asset

Pag-IBIG Acquired assets are properties which are foreclosed due to failure of monthly amortization loan payments. These assets are then made available for purchase to Pag-IBIG members. It is ideal for both low-income earners who want their own home and real estate investors who are looking for ways to maximize their returns.

4. Calamity loan

As we mentioned earlier, Pag-IBIG Calamity Loans are for members affected by calamities. You can take out a calamity loan even if you have an existing Pag-IBIG loan, but the amount you can loan will be subject to some restrictions.

Members may take out up to 80% of their total accumulated value within 90 days from the declaration of a state of calamity.

5. Pag-IBIG II savings program

Pag-IBIG II Savings Program or also known as MP2 Savings Program is a voluntary savings program for members who wish to save more and earn higher dividends than the regular Pag-IBIG Savings Program.

It is open for to active Pag-IBIG Fund members and former Pag-IBIG Fund members with source of monthly income and/or Pensioners, regardless of age, with at least an equivalent of 24 monthly savings.

6. Pag-IBIG overseas program

The Pag-IBIG Overseas Program (POP) is a voluntary savings program which aims to provide Filipinos overseas such as contract workers, immigrants, and naturalized citizens the opportunity to save for their future and the chance to avail of a housing loan of as much as P2M.

(Read: Pag-IBIG Salary Loan Vs SSS Salary Loan: Which One Is Better?)

The Pag-IBIG loyalty card

Pag-IBIG Loyalty Card is HDMF’s membership card which offers huge discounts and rewards in commodities such as medicine, gasoline, tuition fees, etc.

Non-members can also enjoy these benefits by registering online via the Pag-IBIG Fund official website under the E-Service icon.

How to get a Pag-IBIG loyalty card (application process & requirements)

Step 1. Visit Pag-IBIG Fund’s official website.

Step 2. Download the Pag-IBIG Loyalty Card application form.

Step 3. Completely fill up the form and personally submit it to any Pag-IBIG branch office or nearby kiosk. Do not forget to bring other supporting documents and valid IDs.

Step 4. Pay P100 at the cashier.

Step 5. Have your photo taken and validate your information.

Your card will be processed between 15 to 30 days. You can also opt for your card to be delivered directly to your office.

If your Pag-IBIG Loyalty Card application was done through your employer, the card fee may be deducted from your salary.

Benefits of the Pag-IBIG loyalty card

- Get 10% off on published rates for documents and non-document products at DHL

- 20% off on 2GO retail ticket fares (excluding SuperCat)

- 5% off on Air21 domestic shipments

- 5% off on Canon products

- 10% discount on regular items at Mrs. Fields with freebies

- 10% discount on selected flavored popcorn at Chef Tony’s

- 10% discount on David’s Salon hair services

- Up to 50% discount on selected services at Bioessence

- 10 to 30% discount on services and products at George Optical

- 5% off on all services at Hi-Precision Diagnostics

- Up to 50% off on selected Pfizer products as long as you present your doctor’s prescription along with the Pag-IBIG Loyalty Card

- 10% off at Dengue RX Plan Program by PhilLife

- 12% off on PhilCare Individual and Family health plans

- Get Php10 discount on 11Kg Petron Gasul while also earning Petron Peso Points. You can also earn points if you purchase other Petron fuel and oil products.

- 5% discount on generic drugs that bear Rx symbol at The Generics Pharmacy

- Earn 1 Point in Pure Gold for a minimum purchase of P400. Each point is converted to P1.

- 10% discount on room rates at Microtel Inn & Suites

- 10% discount on tuition fee at all Informatics Philippines

- Up to 15% off on Enchanted Kingdom Tickets

- Special Rates under the Healthway Medi-Access Program

- 80% off on package attractions of Manila Ocean Park

- 25% on remittance services fees of iRemit

- Get a Special Free Dish for a minimum bill of Php1,000 in Gerry’s Grill

You may also check other local partners within your area which could give 5%-50% worth of discounts for Pag-IBIG Loyalty Card holders.

(Read: Guide To The Most Powerful IDs In The Philippines – And How To Get Them)

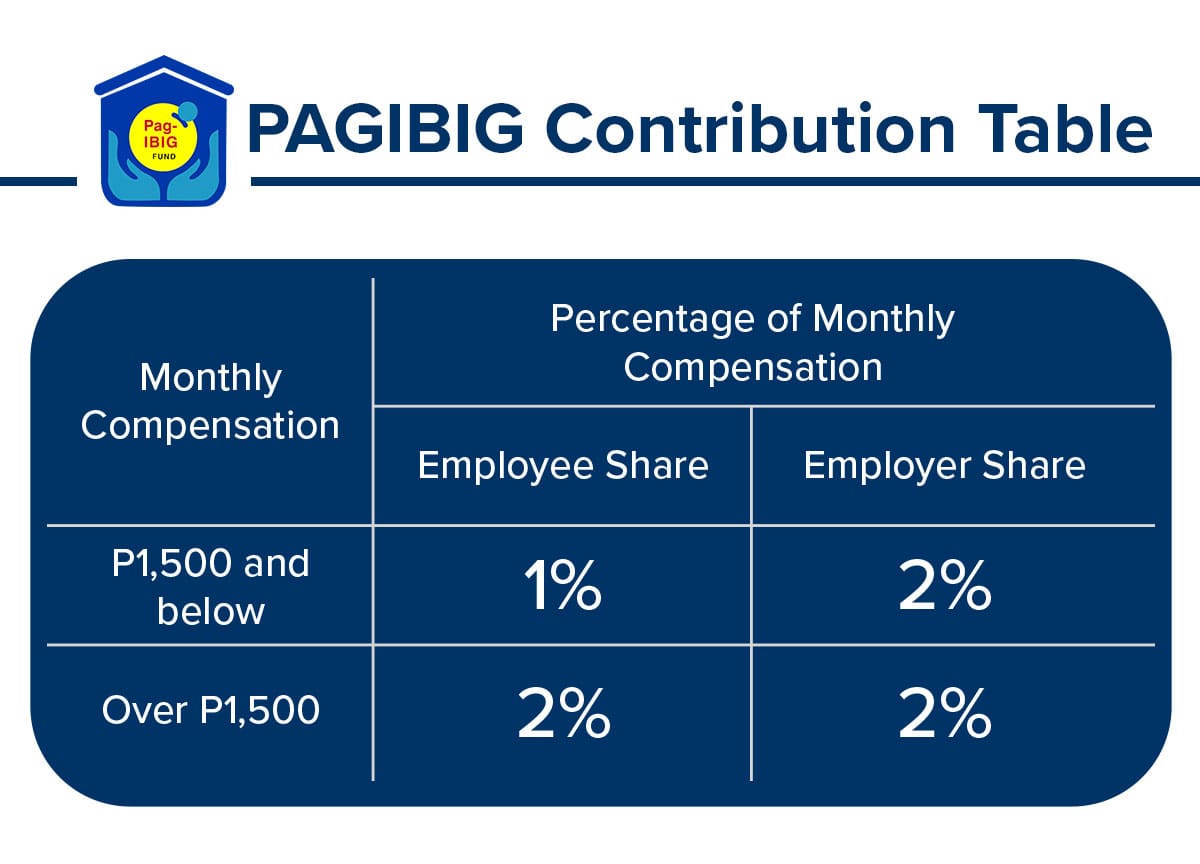

Pag-IBIG Contribution Table

How to compute for your Pag-IBIG Fund monthly contribution

All covered employees and employers shall contribute to Pag-IBIG Fund based on their monthly compensation. Here is a sample computation:

| MONTHLY SALARY | EMPLOYEE’S SHARE | EMPLOYER’S SHARE | TOTAL CONTRIBUTION |

|---|---|---|---|

|

P4,800 |

P96 |

P96 |

P192 |

|

P16,000 |

P100 |

P100 |

P200 |

- Employees earning not more than P1,500 per month shall receive a 1% deduction from their monthly salary.

- Employees earning more than P1,500 per month shall receive a 2% deduction from their monthly salary.

- All employers shall give a 2% share of the monthly compensation of all covered employees.

How to check and verify your Pag-IBIG Fund contribution

There are a few ways on how you can check and verify your Pag-IBIG Fund contributions. OFWs can check their contributions online while employees and voluntary members can do these alternative ways to view their savings.

- You can call Pag-IBIG Fund’s 24/7 hotline at 724-4244.

- Reach them via email at contactus@pagibigfund.com

- Use Pag-IBIG Fund’s chat support.

- Leave a message on Pag-IBIG Fund’s official Facebook page.

- Visit any Pag-IBIG Fund branch near you.

How to claim you Pag-IBIG Fund contribution

There are certain grounds and conditions that will allow you to withdraw your Pag-IBIG Fund contributions. Such are retirement, death, permanent total disability or insanity, termination or separation from service due to health reasons, membership maturity, and permanent departure from the country. Each ground for a claim will require you with different requirements and processes on how you can withdraw your contributions.

Pag-IBIG online services

Pag-IBIG fund offers an online system for the convenience of its members. This is your portal from where you can do your registration, check your contributions and all other services that can help ease the process of claims, verifications, etc. for Pag-IBIG Fund members.