A Complete Guide To Pag-IBIG Online Services

20 min readThe Home Development Mutual Fund (HDMF), more commonly known as the Pag-IBIG fund, offers an online system for the convenience of its members.

One helpful service offered by Pag-IBIG’s online portal is the registration system. This is divided into four categories, the Membership Registration System, Employers Online Registration System, Modified PAG-IBIG 2 Enrollment System, and Kasambahay Unified Registration.

Aside from the registration system, other online services offered include the Online Payment Facility, OFW Member’s Contribution Verification System, Housing Loan Application System, Housing Loan Verification, Housing Loan Moratorium Application System, and the Short-term Loan Filing System

In this article, we will walk you through the basics of Pag-IBIG online services. If you are a contributing member to Pag-IBIG, now is the time to take advantage of the privileges offered and maximize the potential of your monthly contributions. Â

(Read: 5 People Share How They Bought Their First Home)

Pag-IBIG online services

Step-by-step guide to Pag-IBIG member registration

There are three types of people who should participate in and who can benefit from the Pag-IBIG fund: employees, OFWs, and the self-employed.

The first step that all three of these need to take is to register as a Pag-IBIG member. Note that this is a one-time thing.

If you are an employee on your first job, chances are that your employer will register you for Pag-IBIG themselves (and you should make sure they do). If you change jobs, there is no need to re-register; just take note of your registered Pag-IBIG number and the HR/Accounting in your new office should use that number to deposit your monthly contributions.

Step 1. Visit Pag-IBIG’s official website.

To register for a Pag-IBIG membership, just visit their official website and look for the e-services button.

Step 2. Proceed to membership registration

After clicking the e-services button, you will be redirected to another page where you will find the membership registration button. Click to proceed to the membership application page.

In the Online Membership Registration page, click continue.

Step 3. Fill out the form with your name, birthdate and mobile number.

Input some necessary information such as your name, birthdate and mobile number to allow Pag-IBIG to search on their member’s database if whether or not you have registered before and make sure you are a new applicant.

After that, click proceed.

Step 4. Completely fill out the application form with all your personal details.

Upon clicking proceed, you will be redirected to another page which is your virtual Pag-IBIG Fund membership application form.

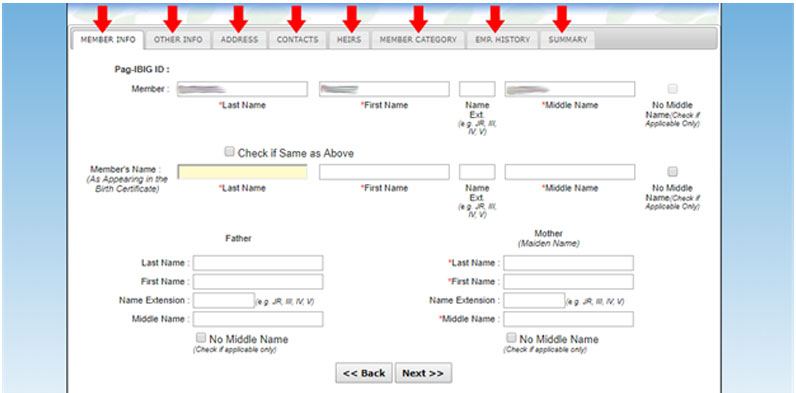

Make sure to fill out all the necessary information asked from you. Also, take note that the form consists of 8 different tabs such as: Member Info, Other Info, Address, Contacts, Heirs, Member Category, and Employment History.

Go through each tab and input all the details being asked.

Step 5. Submit your application

Once you have completely filled-out the form, click the Summary tab and submit your registration. If your sign-up is successful, you’ll be re-directed to the Successful Registration page.

Expect an SMS from Pag-IBIG confirming your registration.

How to view and check Pag-IBIG contributions online

a. For employees and the self-employed

For employees and self-employed members, there are five ways to check your Pag-IBIG contributions:

1. You can call Pag-IBIG’s 24/7 hotline at 724-4244.

2. Send them an email on your inquiry at contactus@pagibigfund.gov.ph

3. Use Pag-IBIG’s chat support.

4. Check out Pag-IBIG’s official Facebook page.

5. Personally visit any Pag-IBIG branch near you.

To speed up the process, take note that whatever method you will be using, you will need to provide your full name, birthdate, and the name of your past and present employers for them to check on your account.

b. For OFWs

Step 1. Visit Pag-IBIG’s official website

To view your Pag-IBIG contributions online, just visit their official website and look for the e-services button. Upon doing so, you will be redirected to another page.

Step 2. Click the OFW Member’s Contribution Verification icon

Under the Membership section, you will find the OFW Member’s Contribution Verification box. Click and proceed to view and verify your contributions.

Step 3. Fill out all necessary information

Fill-out the boxes with your Pag-IBIG MID Number, first name, and last name. Enter the code then click proceed.

For those of you who don’t have their MID Number yet, click the “Click here if you do not have a Pag-IBIG MID No.†button highlighted in blue. You will be re-directed in a separate page where you will need to provide:

- Temporary Registration Form or Registration Tracking Number (provided to you upon registration or application)

- First name

- Last name

Enter the code then click proceed.

Step 4. Click view membership savings.

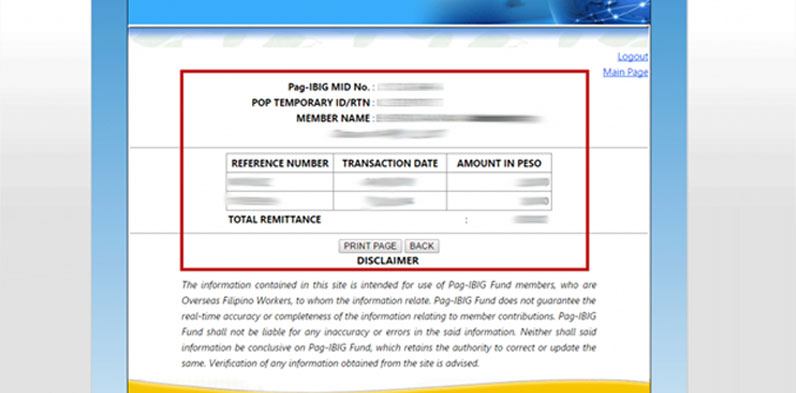

Upon clicking proceed, you will be re-directed to a new page showing your full name and your date of birth. Click the “View Membership Savings†button to check on all your contributions.

NOTE: If you get a “no record found†error upon application, it is possible that your MID Number is not yet active, or you might have been given a different Pag-IBIG MID Number. In cases like these, it is best to proceed to a Pag-IBIG branch near you and verify your number for yourself.

(Read: A Comprehensive Guide To Pag-IBIG Multi-Purpose Salary Loan Application)

How to withdraw from the Pag-IBIG fund and contribution

There are six ways members can withdraw or terminate their membership with Pag-IBIG.

1. Retirement

Here in the Philippines, when you reach the age of 65, you’ll be under compulsory retirement and thus eligible to claim your Pag-IBIG contributions.

If you are in service of the government or from the SSS and GSIS however, you may retire five years earlier at the age of 60 and can still claim your contributions.

In addition, for members under the service of private employers, you can follow your employer’s own retirement plan and can retire as early as 45 years old and can still be eligible make your claims.

Checklist of requirements for retiring Pag-IBIG members

Basic requirements:

- Completely filled-out claim form (Application

for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- Certificate of early retirement (notarized) for private employees (at least 45 years old)

- GSIS Retirement Voucher (for government employees)

- Order of retirement (for members under AFP, PNP, BJMP, and BFP)

- Statement of service (for members under AFP) or service record (for members under PNP, BJMP, and BFP)

2. Death

Contributions of deceased Pag-IBIG members shall be divided among his/her legal heirs in accordance to the New Civil Code as amended by the New Family Code. The claim can also be done through an authorized representative, or any appointed court administrator or executor who can file the application for Provident Benefits Claim.

Checklist of requirements if Pag-IBIG member is deceased

Basic requirements:

- Completely filled-out claim form (Application for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- Death Certificate of member issued by the PSA

- If PSA-issued Death Certificate is not available, you can submit any of the following:

- Death Certificate issued by the Local Civil Registry Office (LCRO) and duly authenticated by PSA.

- Photocopy of Death Certificate issued by PSA and with “Original Document Seen†stamped by Pag-IBIG office (if with Pag-IBIG housing loan and the document was previously submitted to Pag-IBIG office for MRI settlement)

- For a member who died abroad, the Certificate of Death issued abroad should be duly certified by the Philippine Consulate General/ Philippine Embassy in the country where the member died.

- If PSA-issued Death Certificate is not available, you can submit any of the following:

- Proof of Surviving Legal Heirs (HQP-PFF-030, notarized)

- Certificate of No Marriage (CENOMAR) issued by PSA (if the deceased member is single)

- Marriage Contract and Advisory on Marriage issued by PSA (if the deceased member is married)

- Birth Certificate issued by PSA or Baptismal or Confirmation Certificate of all children (if with child/children)

- Affidavit of Guardianship (HQP-PFF-028, notarized) (If with child/children below 18 years, or if child/children is/are physically/mentally incompetent)

- To establish kinship with the deceased member, the claimant shall submit any of the following: a. Birth Certificate issued by PSA or Baptismal or Confirmation Certificate of deceased member/claimant b. Non-availability of Birth Record issued by PSA and Joint Affidavit of Two Disinterested Persons (HQP-PFF-029, notarized)

3. Permanent total disability or insanity

The following disabilities shall be deemed total and permanent:

- Brain injury resulting in incurable imbecility or insanity

- Complete loss of sight for both eyes

- Loss of two limbs at or over the ankle or wrist

- Permanent complete paralysis of two limbs

- Temporary total disability lasting continuously for more than 4 months (120 days)

- Such other cases which are adjudged to be total and permanent disability by a duly licensed physician and approved by the Board of Trustees

Checklist of requirements for disabled Pag-IBIG members

Basic requirements:

- Completely filled-out claim form (Application for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- Certification or statement from a physician

- SSS Total Disability Voucher (for private employees)

- Updated Statement of Service, Statement of Last Payment, and Compulsory Disability Discharge (CDD) Order (for AFP, Philippine Navy, and Army members)

4. Termination or separation from service due to health reasons

If you can no longer work because of severe health conditions, you can still make a claim for your Pag-IBIG contributions provided that you will be accompanied by a doctor’s certificate upon doing so.

Checklist of requirements for terminated due to health reasons Pag-IBIG members

Basic requirements:

- Completely filled-out claim form (Application for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- Certification or statement from a physician

- Notarized sworn employer’s Certification of member’s employment termination due to health reasons

- Latest SSS Disability Voucher (for private employees)

5. Membership maturity

A member must have remitted at least 240 monthly membership contributions before she can make a claim. For Pag-IBIG Overseas Program (POP) members, depending on the option of their membership, it shall end either 5, 10, 15, or 20 years.

Checklist of requirements for members with matured contributions

Basic requirements:

- Completely filled-out claim form (Application for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- PSA-issued Birth Certificate, SSS, or GSIS Retirement Voucher or at least 2 Valid IDs with birthdate, photo, and signature

- Notarized Certificate of Early Retirement (for private employees aged 45 and above)

- Order of Retirement, Updated Statement of Service, and Statement of last Payment (for AFO, Philippine Navy, and Army members)

6. Permanent departure from the country

You can withdraw your Pag-IBIG contributions before you leave the country to live permanently abroad. In order to do so, you have to show proof of your new residence before you can get approval of the claim.

Checklist of requirements for members permanently departing the country

Basic requirements:

- Completely filled-out claim form (Application for Provident Benefits (APB) claim form)

- Original and photocopy of 2 valid IDs (including Pag-IBIG Loyalty Card, if any)

- Updated service record (for government employees)

- Special Power of Attorney and 2 valid IDs each for the member and authorized representative (for members who can’t make their claims personally)

Additional requirements:

- Notarized Sworn Declaration of Intention to Depart from the Philippines Permanently

- Photocopy of passport

- Immigrant visa, residence visa, settlement visa, or any other equivalent document

Steps in filing Pag-IBIG Provident Benefits Claim

Step 1. Visit the Pag-IBIG branch where you have your membership records

We suggest that before applying for a membership, see to it that the branch where you file your application is somewhat near you so that when you process your claims, loans etc. it will be less hassle for you and it will be easier for you to monitor your application.

Step 2. Compile and submit all necessary requirements

Compile all the requirements asked from you and check every single detail you have inputted before submitting your application.

Step 3. Wait for the verification process to be complete

In this step, a Pag-IBIG staff will check your records to verify if whether or not you have any balances be it for unpaid Pag-IBIG housing loan, multi-purpose loan, or calamity loan. Be sure to clear all your balances before processing your application to avoid delays.

Step 4. Issuance of Provident Benefits Acknowledgement Receipts

A Pag-IBIG staff member will issue a Provident Benefits Acknowledgement Receipt upon verification of your application. This claim stub will indicate the date of pick-up of your check.

Step 5. Withdrawal of claim

The claiming process takes around a week to almost a month (8-20 working days) depending on the branch where you have submitted your claim.

If you process the withdrawal of your claim on the same branch where you have applied your membership, it will be faster for your payment history and other records are readily available. Double check the date stated on your acknowledgement receipt for the exact pick-up date of your claim.

If your claim is released through check, just visit the designated Pag-IBIG office, present your claim stub and 2 valid IDs at the cashier.

However, if your claim is released through your disbursement or payroll account, just visit any accredited ATM or bank and check if whether or not your proceeds are ready for withdrawal.

(Read: Beyond Pensions And Loans: 3 Government Savings Programs To Check Out)

Guide to Pag-IBIG payment facilities

a. For employees and self-employed members

There are seven ways you can pay your Pag-IBIG amortizations and contributions:

1. Over-the-counter payment

• Monthly Savings (Pag-IBIG I and Modified Pag-IBIG 2 (MP2), Housing Loan (HL) Amortizations and STL for OFW

- Bayad Centers

- ECPay

- M. Lhuillier

- SM Business Centers (including SaveMore and HyperMarket)

• HL Amortizations only

- Landbank of the Philippines

- Metrobank

Steps to follow in paying your Pag-IBIG contributions through over-the-counter payments channels (Bayad Center, ECPay, M. Lhuillier):

Step 1. Completely fill out payment formSte

Provide your MID, MP2 Account Number or Housing Account Number (HAN) which can be found on your monthly billing statement or previous official receipts.

Step 2. Payment

Pay your Pag-IBIG Fund due on the cashier.

Step 3. Wait for the receipt

Receive the machine-validated payment slip indicating the transaction reference number. This will serve as your official receipt and proof of payment.

2. Thru Globe G-cash mobile payment (for Globe and TM subscribers)

Register to GCash using your Globe/TM Sim

Paying your Pag-IBIG amortizations and contributions through Globe G-cash mobile payment:

Step 1. Contact GCash hotline

Dial *143# and press call. (no charge)

Step 2. Register

Select GCash at the choices and register. Provide the details required.

Step 3. Wait for the registration code

Wait for the registration code and enter it for verification. Confirm the details that you have provided and agree on the “Terms and Conditionsâ€.

Step 4. Wait for the transaction reference number

Once the transaction is successfully completed, you will receive an acknowledgement message with your reference number on it. You will also be asked to change your MPIN for security purposes.

How to convert cash to GCash (cash-in) – only applicable for Globe and TM subscribers

You can do cash-in through these channels:

- BancNet ATM

- Insert your ATM card in the machine of any BancNet bank.

- Choose the “Fund Transfer†option.

- Key in your 11-digit mobile number when asked for your account number.

- Wait for the text confirmation once the transaction has been completed.

- Online bank transfer (for those with active bank accounts)

- Mobile phone banking

- Any GCash outlet

- Go to any GCash outlets near you

- Fund your GCash wallet and convert your money to GCash.

- Use your GCash wallet in paying for your contributions through the GCash mobile app.

- Dial *143# and choose GCash.

- Enter the required details.

- Wait for the transaction summary which reflects your program type and amount after accomplishing payment details.

- Confirm amount entered, type of transaction and PRN to complete the transaction.

- Wait for the electronic acknowledgment message.

3. Credit Card payment (Monthly Savings)

There are 9 steps to follow in paying your Pag-IBIG amortizations and contributions through monthly credit card deductions:

STEP 1 – Log-on to Pag-IBIG Fund website.

Visit Pag-IBIG Fund’s official website.

STEP 2 – Choose E-Services.

Click E-Services and select “Online Payment Facilityâ€.

STEP 3 – Provide necessary details.

Under Online Payment Facility, accomplish the following required information to pay through monthly deductions on your credit cards:

- Membership Category (Local or Overseas)

- Pag-IBIG Membership Identification (MID) No./Registration Tracking No. (RTN)

- Monthly Savings (Amount Due)

- Period Covered

- Member’s Cell Phone Number/Email Address

STEP 4 – Select mode of confirmation

Select what mode will be used in receiving the payment confirmation. If thru:

- SMS – provide your mobile number

- Email – provide your email address

STEP 5 – Enter code.

Enter CAPTCHA code and agree on the “Terms and Conditions†then click proceed.

STEP 6 – Check payment details.

The system will display the payment summary and you will be asked to check for the payment details that you have provided before you proceed with the payment. After checking the payment details, click proceed.

STEP 7 – Choose type of credit card.

Choose the type of credit card that will be used in the transaction. (Visa or Mastercard)

STEP 8 – Accomplish credit details page.

Accomplish and confirm required credit card details. (credit card no., expiry date of credit card, credit card verification number etc.)

STEP 9 – Wait for the confirmation message.

Once payment transaction is completed, the Payment Result will be displayed reflecting the Merchant Reference No. and Payment Reference No. which shall serve as proof of payment. The member will receive an SMS or an Email notification concerning the recent credit card transaction.

4. Payment thru 7-Eleven stores (via CashPinas Moneygment App)

There are 10 steps to follow in paying your Pag-IBIG amortizations and contributions through 7-Eleven stores via CashPinas Moneygment App:

STEP 1 – Download and install the Moneygment App.

STEP 2 – Register or log-in.

New users may use their Facebook, Gmail or other email address.

STEP 3 – Select “Pay your SSS, PhilHealth, Pag-IBIG†link.

STEP 4 – Fill in your account details.

STEP 5 – Select “Pag-IBIGâ€, then select payment type.

- Membership Savings

- Modified Pag-IBIG II

- Housing Loan Amortization

STEP 6 – Input your Pag-IBIG Housing Loan details.

- MID for membership savings

- MP2 Account Number for the Modified Pag-IBIG2

- Housing Account Number (HAN) for housing loan amortization

STEP 7 – Confirm your Payment.

STEP 8 – Select payment method.

- If thru 7-Eleven, you will be re-directed to the 7-Eleven payment instructions page.

STEP 9 – Follow instructions and pay at any 7-Eleven stores.

STEP 10 – Wait for the printed receipt.

5. Payment thru 7-Eleven stores (via ECPay)

There are 6 steps to follow in paying your Pag-IBIG amortizations and contributions through 7-Eleven stores via ECPay:

STEP 1 – Visit the ECPay website.

STEP 2 – Register using your mobile number.

You will be required to register using your mobile number. You will also be asked for a password for security reasons.

STEP 3 – Input your Pag-IBIG details then click “Validateâ€.

The member-borrower will be able to see his/her payment details (e.g. Area Code, Contact Number, and the Amount to be paid) after providing his/her details. Also, the member-borrower may opt to change the amount to be paid.

- MID for membership savings

- MP2 Account Number for the Modified Pag-IBIG2

- Housing Account Number (HAN) for housing loan amortization

STEP 4 – Upon clicking the 7-Eleven button, you will be re-directed to 7-Eleven’s Payment Instruction Page.

STEP 5 – Payee must present the Payment Instruction Page to any 7-Eleven branch for the payment.

You have 24 hours to pay your amortization at any 7-eleven stores.

STEP 6 – A printed receipt will be issued as a confirmation that your transaction has been processed successfully.

6. Payment thru Coins.ph

There are 5 steps to follow in paying your Pag-IBIG amortizations and contributions through Coins.ph:

STEP 1 – Create a Coins.ph account.

STEP 2 – Cash in at any 7-Eleven branch.

Get P100.00 free credit with a minimum cash in of P250.

STEP 3 – Tap “Pay Bills†& choose the type of Pag-IBIG Fund payment you need to settle.

- Membership Savings

- Modified Pag-IBIG II

- Housing Loan Amortization

STEP 4 – Enter your Pag-IBIG details and slide to pay.

- MID for membership savings

- MP2 Account Number for the Modified Pag-IBIG2

- Housing Account Number (HAN) for housing loan amortization

STEP 5 – Wait for the confirmation message.

Upon confirmation, you will receive an electronic acknowledgment message.

7. Payment thru employer’s on-line payment facility

Here are the authorized payment channels if you will be paying through employer’s payment facility:

- Union Bank of the Philippines (UBP)

- Bank of the Philippine Islands (BPI)

- Land Bank of the Philippines

- Security Bank

- BancNet

- AUB

- CHINA BANK

- CITIBANK

- CTBC

- DBP

- EAST WEST

- METROBANK

- PNB

- RCBC

- STANDARD CHARTERED

- PHILTRUST BANK

- PBCom

- Bank of Tokyo

- Bank of Commerce

- ROBINSONS BANK

- UCPB

- Veterans Bank

- BDO

- Citystate Savings Bank

- RCBC Savings

- Maybank

Steps to take to pay your Pag-IBIG amortizations and contributions through employer’s payment facility:

STEP 1 – Enroll with your chosen bank’s electronic collection facility.

- Accomplish the bank’s enrollment form and comply with the bank’s requirements

- Once approved, the bank shall provide you access (bank provides the user ID and passwords) to its electronic collection facility.

STEP 2 – Remit Membership Savings (MS)/Loan Amortizations (LA)

- Log in to your chosen bank’s website (or to the Pag-IBIG website – click the bank’s logo and it will automatically link you to your chosen bank’s website).

- Upload collection file based on Pag-IBIG Fund’s file structure format.

- Registered Authorizer(s) of the employer receives electronic notification for each successful upload.

- Registered Authorizer(s) of employer approves payment for MSS/STL

- For successful transactions, the Transaction Reference Number shall be displayed.

- Retrieve electronic receipt from the system/Print Transaction Reference Number (TRN) to serve as proof of payment in lieu of Pag-IBIG Fund Receipt (PFR).

b. For OFWs

1. Payment thru Overseas Remittance of Monthly Savings/Loan Amortizations

OFWs can pay amortizations and contributions at the following Collecting Agents and Remittance Company partners:

a. Banks

- Philippine National Bank (PNB)

- Asia United Bank (AUB)

- I-Express Remit Mo Sa Pag-IBIG

- I-Text Mo Sa Pag-IBIG

- Foreign Tie-Up

b. Non-Banks

- CASHPINAS Remittance Corp.

- I-Remit

- Ventaja (including PayPilipinas)

Step-by-step process for paying through these OFW-friendly channels:

Payment through I-Express Remit Mo Sa Pag-IBIG

There are 3 steps to follow in paying your Pag-IBIG contributions and amortizations through I-Express Remit Mo Sa Pag-IBIg

STEP 1 – Secure and accomplish Partner’s Remittance Application Form.

STEP 2 – Pay Members Savings/Loan Amortizations.

STEP 3 – Wait for an official receipt.

You will receive the machine-validated Transaction Slip, which will serve as your official receipt in lieu of Pag-IBIG Fund Receipt (PFR).

Payment through I-Text Mo Sa Pag-IBIG

There are 3 steps to follow in paying your Pag-IBIG contributions and amortizations through I-Text Mo Sa Pag-IBIG:

STEP 1 – Secure and accomplish Partner’s Remittance Application Form.

STEP 2 – Send Redi Money Number and Membership Identification (MID) Number MID/Loan Number

You can do this through Short Messaging System (SMS) via mobile phone.

STEP 3 -Wait for a text message signaling a successful payment transaction.

Payment through I-Remit

There are 2 steps to follow in paying your Pag-IBIG contributions and amortizations through I-Remit:

STEP 1 – Accomplish and submit iRemit Remittance Application Form and Auxiliary Service Form to iRemit Teller.

The amount specified in the payment/remittance form must be in Philippine Peso for payment of MS/Loan Amortization. The U.S. dollar is converted to the local currency using the prevailing local currency/US$ rate as determined by iRemit.

STEP 2 – Wait for proof of payment.

Upon settlement, you will receive a validated Official Receipt (OR), reflecting a unique reference transaction number from iRemit Teller which will serve as proof of payment.

Payment through Ventaja

There are 2 steps to follow in paying your Pag-IBIG contributions and amortizations through Ventaja:

STEP 1 – Accomplish and submit Remittance Application Form as basis for payment details.

The amount specified in the payment/remittance form must be in Philippine Peso for payment of MS/Loan Amortization. The U.S. dollar is converted to the local currency using the prevailing local currency/US$ rate as determined by Ventaja’s tie up Remittance partner.

STEP 2 – Wait for proof of payment.

Upon settlement, you will receive an official Remittance Receipt reflecting a unique reference transaction with attached Ventaja’s valid receipt which will serve as proof of payment.