Employee Benefits in the Philippines: Complete List, Guide, and FAQs

14 min read

In any company, whether big or small, the greatest asset is the people. The company wins when they perform well, and the company suffers if they don’t.

As an employer, you are obliged to take care of your company’s people by giving them the proper employee benefits as mandated by the government. By following these labor laws and ensuring your employees understand their benefits you will help increase job satisfaction which, in turn, will improve their work performance and positively impact your company.

Here are the important things you need to know about employee benefits in the Philippines, as mandated by the government:

Types of Employee Benefits

When you are employed, you are entitled to various benefits that can be summed up into three categories: employee minimum wage and additional pays due to varying factors like holidays or overtime, leave benefits which are paid absence from work, and mandatory government contributions. Each one will be elaborated below.

Wage and compensations Benefits

1. Employee minimum wage*

| Region | Region Minimum Wage Increase |

|---|---|

| NCR | P537 (Effective November 22, 2018) |

| CAR | P300 — P320 |

| Region I | P256 — P310 |

| Region II | P340 |

| Region III | P393 — P400 (P339 in Aurora) |

| Region IV-A |

GCA: P325.50 — P400 EGA: P317.50 — P344 RBA: P317 — P327 |

| Region IV-B |

Establishments with 10 workers or above: P290 Establishments with less than 10 workers: P247 |

| Region V |

Upon effectivity: P305 (for establishments with 10 or more employees) P295 (for establishments with less than 10 employees) |

| Region VI | P365 |

| Region VII | P366 |

| Region VIII | P305 |

| Region IX | P316 |

| Region X |

WCI — P338.00 WCII — P331.00 WCIII — P323.00 WCIV — P304.00 |

| Region XI |

Upon effectivity: P370 |

| Region XII | P311 |

| Region XIII | P305 |

| ARMM | P280 |

2. Overtime pay

The employee who renders service beyond the schedule indicated in the contract will be given additional compensation equivalent to his regular wage including at least 25% premium.

| Sample Computation | |

|---|---|

| Monthly salary | P20,000.00 |

| Working days per month | 26 |

| Daily salary | P769.23 |

| Per hour rate | P96.15 |

| Overtime rate | 125% |

| Per hour rate-overtime | P120.19 |

| Employee overtime (in hours) | 3.50 |

| Total Overtime pay | P420.67 |

3. Premium Pay

A premium pay is an overtime pay for rest days and official holidays. Employee shall be paid an additional compensation from the rate of the first eight hours on a holiday or rest day plus at least 30%. There are three types:

-

Regular Holidays – these refer to fixed dates like Christmas Day, Independence Day, or New Year’s Day. However, National Heroes Day and Holy Week are considered regular holidays despite changing dates.

-

Special Holidays – also known as Special Non-Working Holidays, they fall on flexible dates, depending on the circumstance. Examples are ASEAN Summit or regional events like festivals or class suspensions. A day becomes a special holiday if: proclaimed by the President, enacted by the Congress, or 3) declared by LGUs in the specific regions.

-

Double Holidays – this is a rare occurrence wherein a regular holiday and a special holiday fall on the same day. Example: President Rodrigo Duterte declared August 21, 2018 as special non-working (Eid’l Adha) and regular holiday (Ninoy Aquino Day) at the same time.

All employees are eligible for premium pay, but normally, the slots for working on holidays or rest days are scheduled in advance and approved by authorized personnel.

Now, how do you compute for premium pay? Computation differs for each type. Please, refer below:

- Working on Rest day Premium / Working on Special Holiday PremiumBoth types of premium follow the same formula: (Hourly rate × 130% × 8 hours)

Sample Computation Hourly rate 81.49 Rest day/ Special Holiday pay 130% Hours of duty 8 Total premium P847.496‬ - Working on Special Holiday and at the same time Rest day Premium = (Hourly rate × 150% × 8 hours)

Sample Computation Hourly rate 81.49 Special Holiday and Rest Day Pay 150% Hours of duty 8 Total premium P977.88‬ - Working on Regular Holiday Premium = (Hourly rate × 200% × 8 hours)

Sample Computation Hourly rate 81.49 Regular Holiday Pay 200% Hours of duty 8 Total premium P1,303.84‬ - Working on Regular Holiday and at the same time Rest day Premium = (Hourly rate × 260% × 8 hours)

Sample Computation Hourly rate 81.49 Regular Holiday and Rest day pay 260% Hours of duty 8 Total premium P1,694.992‬ - Working on a Double Holiday Premium, and Working on a Double Holiday and at the same time Rest day PremiumBoth types of premium follow the same formula: (Hourly rate × 300% × 8 hours)

Sample Computation Hourly rate 81.49 Double Holiday / Double Holiday and Rest day Pay 300% Hours of duty 8 Total premium P1,955.76‬

4. Night Shift Differential

Also known as night shift pay, it applies to employees who work between 10:00 PM and 6:00 AM.

An additional 10% premium is applied for every hour at work.

The following are eight types of NSD:

- Night shift on an ordinary day = (per hour rate × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Additional Premium 10% Working hours per day 8 hours Total NSD P76.92 - Night shift on a rest day = (per hour rate × 130% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Rest day premium 130% Additional Premium 10% Working hours per day 8 hours Total NSD 99.996‬ - Night shift on a regular holiday = (per hour rate × 200% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Rest day premium 200% Additional Premium 10% Working hours per day 8 hours Total NSD 153.84‬ - Night Shift on Special Holiday = (per hour rate × 130% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Special holiday premium 130% Additional Premium 10% Working hours per day 8 hours Total NSD 99.996‬ - Night Shift on a double holiday = (per hour rate × 330% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Double holiday premium 330% Additional Premium 10% Working hours per day 8 hours Total NSD 253.836 - Night Shift on a regular holiday plus rest day = (per hour rate × 260% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Regular holiday premium + Rest day premium 260% Additional Premium 10% Working hours per day 8 hours Total NSD 199.992 - Night Shift on special holiday plus rest day = (per hour rate × 150% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Special holiday premium + Rest day premium 8 hours Additional Premium 150% Working hours per day 10% Total NSD 115.38‬ - Night Shift on double holiday plus rest day = (per hour rate × 390% × 10% × 8 hours)

Sample Computation Per hour rate 96.15 Double holiday premium + Rest day premium 390% Additional Premium 10% Working hours per day 8 hours Total NSD 299.988‬

5. 13th Month Pay

The 13 month pay is often mistaken as the Christmas Bonus, but technically, it’s a monetary bonus mandated by law. The Christmas bonus is only a voluntary gesture from the employers. According to the law, the 13 month pay is given either in 2 installments (May and December) or in full before December 24.

You can receive this pay if you are any private employee with fixed or guaranteed salary who have worked for at least one month. Resigned or terminated employees who left their employers before the release of the 13 month bonuses can also receive this. Take note that employees who quit the job without going through the separation process and workers who are paid purely on commission are not entitled for 13 month pay.

How do you compute the amount you’ll receive? It depends on your basic pay times the number of months you rendered for the whole year and divided by 12. Example: In case of perfect attendance, the employee will get the full monthly salary for 13th month pay. Generally, it’s a bonus amounting to one month of basic pay.

| Sample Computation | |

|---|---|

| Gross Monthly Salary | P30,000.00 |

| Perfect attendance (12 months) | P30,000 x 12 months / 12 months |

| Total take home 13th month pay | P30,000 |

If ever you wondered why you receive different rates of 13 month bonus, that’s because it is pro-rated. It means that the amount of pay will be adjusted to the total time you rendered the services. As a result, what you will receive may not be the same with your monthly basic pay and may differ from other employees because of variables.

Absences or unpaid leaves will be deducted from the basic salary before being divided by 12. Also, other benefits on top of your basic pay like unused credit service incentive leaves, overtime, premium, night differential, and allowances are not part of the computations. Deduction from the bonus is possible to cover the upcoming tax deficits.

The 13 month pay is basically not taxable, except for the amount of P82,000. Under the new TRAIN law, tax exemptions now cover the rate of P90,000.

6. Separation pay

Separation pay is also part of the Labor Code and is given to employees terminated from the company. The only exception are those terminated because of misconduct or crime involvement.

There are two types:

-

1/2 Month Pay per Year of Service – an employee is eligible for separation pay with the value of one-half (1/2) month pay for every year of service if the separation from the service is because of retrenchment to save the company from pitfalls, closure or termination of the operations due to bankruptcy and other bad instances, and grave illness incurable within 6 months or harmful for co-workers.

-

One-Month Pay per Year of Service – an employee is eligible for a separation pay worth of one month per year of service if the termination of the contract is because of: installation of devices or machines that reduce the number of labors, redundancy, or when there is excessive manpower, impossible reinstatement to the former position because of significant reasons.

7. Retirement pay

Upon the age of 60 years or more, an employee who has served at the establishment for at least five years may be granted a retirement pay equivalent to at least one-half month of salary for every year of service. A fraction of at least six months is considered as one whole year.

As stipulated by the DOLE National Wages and Productivity Commission, “The minimum retirement pay shall be equivalent to one-half (1/2) month salary for every year of service, a fraction of at least six (6) months being considered as one (1) whole year.â€

Included in the one-half pay are 15 days salary based on the latest salary rate, cash equivalent of 5 days of service incentive leave, one-twelfth (1/12) of the 13th month pay.

How to compute the pension:

(1/12 x 365/12 = .083 x 30.41 = 2.5)

Minimum Retirement Pay = Daily Rate x 22.5 days x number of years in service

Leave benefits

1. Service Incentive Leave

Article 95 of the Labor Code says that an employee who has worked for a year is entitled to five (5) SILs with full pay. These can be used for vacation leave or sick leave.

2. Parental leaves

There are 3 types of parental leaves:

- Maternal – any pregnant woman employee who has worked with the company for at least six months will be granted a maternity leave of at least two weeks prior to her due date (expected date of delivery) and four weeks after normal delivery or miscarriage with full pay based on her regular salary.As of February 21, 2019, the Expanded Maternity Leave (EML) Bill has been signed into law. This law grants 105 days of paid maternity leave credits. The law also allows new mothers to extend this leave for an additional 30 days, but this will be unpaid.

The EML is applicable to all a woman’s pregnancies.

- Paternal – the R.A No. 8187, or Paternity Leave Act of 1996, grants seven (7) days of fully paid leave to married fathers. This is effective up to the first four deliveries of the legitimate spouse.Under the EML, seven days of a woman’s paid maternity leave credits can be transferred to fathers, extending the allowed seven-day paternity to be extended to 14.

- Solo Parent – Solo or single mothers and fathers have seven days leave with pay for every year of service, on top of other leave privileges, e.g. Maternity or Paternity Leave.Solo mothers are covered by the EML, so they also get 105 days of paid maternity leave credits. However, solo mothers can extend their leave for 15 days and these should be paid leaves.

3. Special Leave Benefits for Women

There are two types:

-

Magna Carta for Women – this entitles women who underwent surgery due to gynecological disorders to two months’ leave with full pay, as stipulated in R.A. 9710 or the Magna Carta of Women. This applies to employees who have rendered at least six months of service with the company.

-

Leave for women and their children who are victims of violence – victims of violence against women, as stipulated in R.A. 9262 or the Anti-Violence Against Women and Their Children Act of 2004, are entitled to 10 days leave with full pay.

4. Bereavement Leave

This is a 3 days additional time off from work to mourn for the death of immediate family members such as mother, father, siblings, and children. It must be noted that this is not a paid leave.

5. De Minimis Benefits

These are either relatively small amounts of money or leave credits that are optional for employers to grant. Examples are calamity leave, rice subsidy, transportation/clothing/laundry allowance, daily meal allowance, other goods that are not monetary.

Mandatory government contributions

The following government contribution will be automatically deducted from regular employees based on their salary:

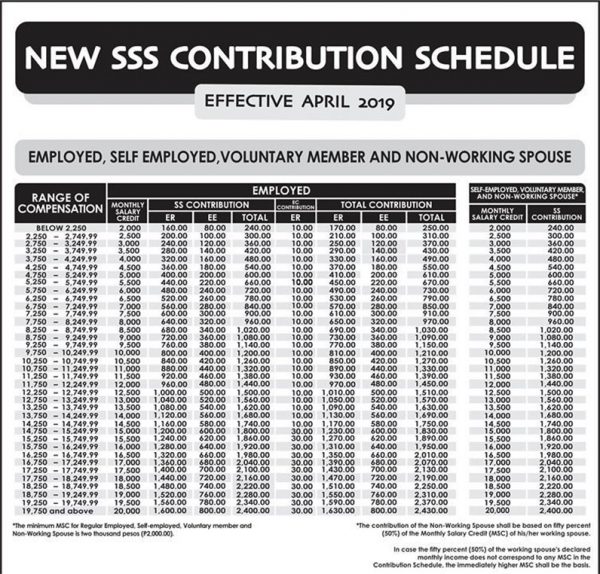

1. SSS

The Social Security System serves as an insurance program set by the government for all wage earners from the private institutions (the counterpart for government employees is GSIS) in the country.

Members are required to contribute a certain amount depending on their salary bracket.

Generally, your monthly contribution is a shared payment between you (EE) and your employer (ER):

ER – 7.37% of the total contribution

EE – 3.36% of the total contribution (deducted from the salary).

Example: refer to the table.

If you earn P14,437 per month, your salary credit according to the table is deemed as P14,500.

Your employer will pay P1,160 (7.37%) – on top of that is the additional fee of P10 – amounting to P1,170.

Adding the remaining P580 (3.63%) from you, the table shows that your total contribution per month is P1740.

To check your contributions online, you need to create an account at My.SSS and have it validated by SSS personnel. You can also view your membership records, file salary loan application, or schedule appointments.

The benefits given by SSS are for sickness, maternity, disability, retirement benefit (pension), death cash grant, funeral grant, and salary loan.

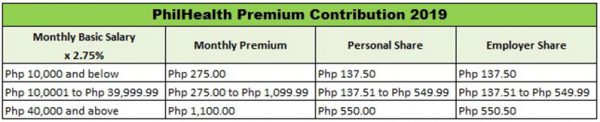

2. PhilHealth

This serves as a health insurance program for private employees providing financial aid and service privileges for health care.

PhilHealth has removed the previous salary brackets, creating a new condensed contribution table with P10,000 as the salary floor and P40,000 as the ceiling. The computation starts at 2.75% of the basic salary per month, and the payment is shared by employer and employee.

The PhilHealth benefits include:

- Inpatient benefits (hospitalization, facility fees, and physician/surgeon fees)

- Outpatient benefits (day surgeries, radiotherapy, hemodialysis, outpatient blood transfusion, primary care benefits)

- Z benefits (financial/medical aid for the patients with cancer and in need of surgeries)

- SDG related (Malaria package, HIV-AIDS package, anti-Tuberculosis treatment, voluntary surgical contraception procedures, and animal bites treatment)

3. Pag-IBIG

Also known as the Home Development Mutual Fund (HDMF), Pag-IBIG is another form of national savings program and the financing office for affordable shelter.

| Salary per month | Employee share | Employer share |

|---|---|---|

| P1,500 and below | 1% | 2% |

| Over P1,500 | 2% | 2% |

Again, the total contribution is shared between you and the employer. The highest compensation per month subjected to Pag-IBIG contribution is P5,000 and it means that the employer and employee will pay P100 each as the maximum contribution.

Pag-IBIG lets you have the following benefits: housing loan, multi-purpose loan, calamity loan, secured savings.

For Kasambahay (Househelpers) Wage Orders:

*Househelpers are not included in the above list as a more specific law is in place under the Republic Act (R.A.) No. 10361, or Domestic Workers Act. A minimum monthly salary of P2,500 applies to house helpers in NCR, P2,000 in chartered cities and first-class municipalities, and P1,500 in other municipalities.

Kasambahays are also entitled to other leave benefits such as 13 month pay, 5 annual SIL, and rest days. However, government-mandated insurance programs like SSS, PhilHealth, and Pag IBIG have specific computations of contributions provided by the law.

| Region | Minimum Wage Rate |

|---|---|

| NCR | NCR P3,500 |

| CAR |

P3000 for chartered cities and municipalities; and P2500 for other municipalities |

| Region I |

P3500 for chartered cities and municipalities; and P2500 for EGA, RBA, and other municipalities |

| Region II | P2500 |

| Region III |

P4000 for cities and first class municipalities P3000 for other municipalities |

| Region IV-A |

P2500 for GCA (chartered cities and municipalities) P1800 for EGA and RBA (other municipalities) |

| Region IV-B |

P2500 for cities and first class municipalities P2500 for other municipalities |

| Region V |

P3000 for cities and first class municipalities P2500 for other municipalities |

| Region VI | P4000 |

| Region VII |

P3000 for cities and first class municipalities P2500 for other municipalities |

| Region VIII |

P2500 for chartered cities and municipalities P2000 for other municipalities |

| Region IX |

P2500 for chartered cities and municipalities P2000 for other municipalities |

| Region X | P3000 for cities and first class municipalities |

| Region XI |

P3000 for cities and first class municipalities P2000 for other municipalities |

| Region XII |

P2500 for chartered cities and municipalities P2000 for other municipalities |

| Region XIII |

P3000 for cities and first class municipalities P2500 for other municipalities |

Do you have complaints about not receiving the pay you are supposed to receive? Contact Department of Labor and Employment for proper proceedings. This government office has launched a 24/7 customer service line for inquiries and assistance.

- DOLE Hotline: 1349

- You can also directly submit a message to their website through this link.

Whether you are looking for a job or already employed, you must be aware of your rights from the company aside from the responsibilities you signed for. After all, a person works to get an income and these employee benefits.