Why You Really Need To ‘Pay Yourself First’ While You’re Young

2 min readYou probably hear it all the time. Every financial advice tells you to “pay yourself first.â€

It means setting aside a portion of your income for savings before getting yourself a “payday mocha frappeâ€â€”or whatever items you plan to splash your cash on.

Requiring yourself to prioritize savings allows you to make bigger purchases in the future and secure your budget for emergencies.

For Benj and Fely Santiago, vice chairmen of Truly Rich Makers and authors of self-help book Debt Destroyers: How We Rose from Our Quagmire of Debt to Financial Freedom, the “pay yourself first†concept helped them realize why they were drowning in debt.

“We were paying others first instead of paying ourselves first,†the couples says in their book.

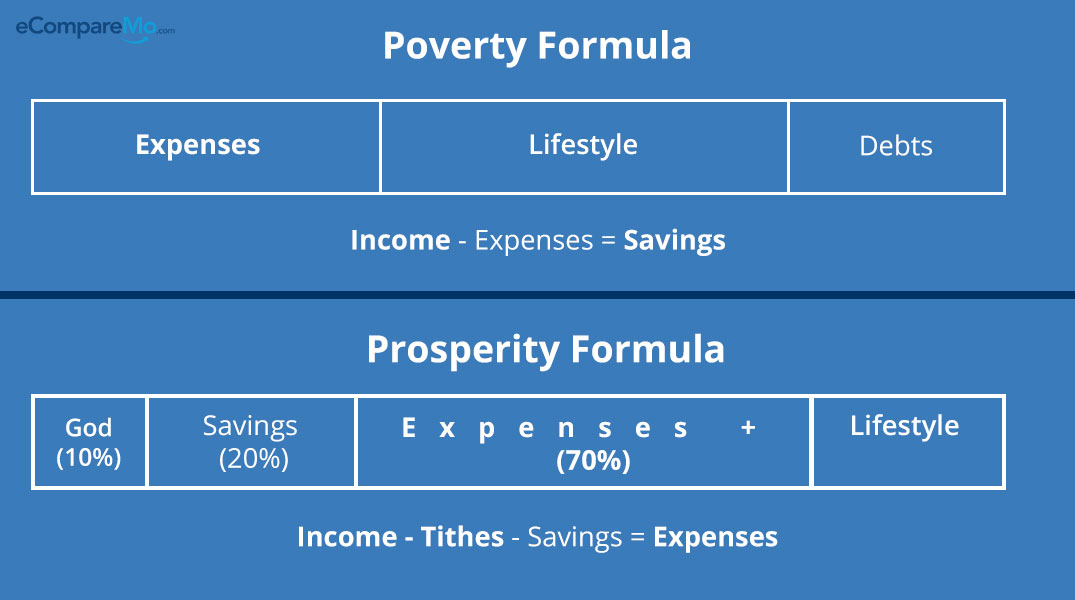

Benj and Fely took inspiration from Bo Sanchez’s Abundance Formula, or the 70-20-10 principle. Here’s how the Prosperity Formula works, as opposed to the Poverty Formula:

Below is a detailed breakdown of the 70-20-10 Rule according to financial advisors:

- 70% for food, clothing, rent, transportation

- 10% for debt payment

- 20% for savings

- 5% for emergency fund

- 5% for travel and leisure

- 10% for retirement fund

This method requires discipline, though. In case the percentage allocated for the living expense won’t suffice, experts suggest that you make an adjustment of 5% on your savings.

However, if you are driven enough to strictly comply to allocating 10% to your savings, do away with debt.

Treading the path toward financial stability

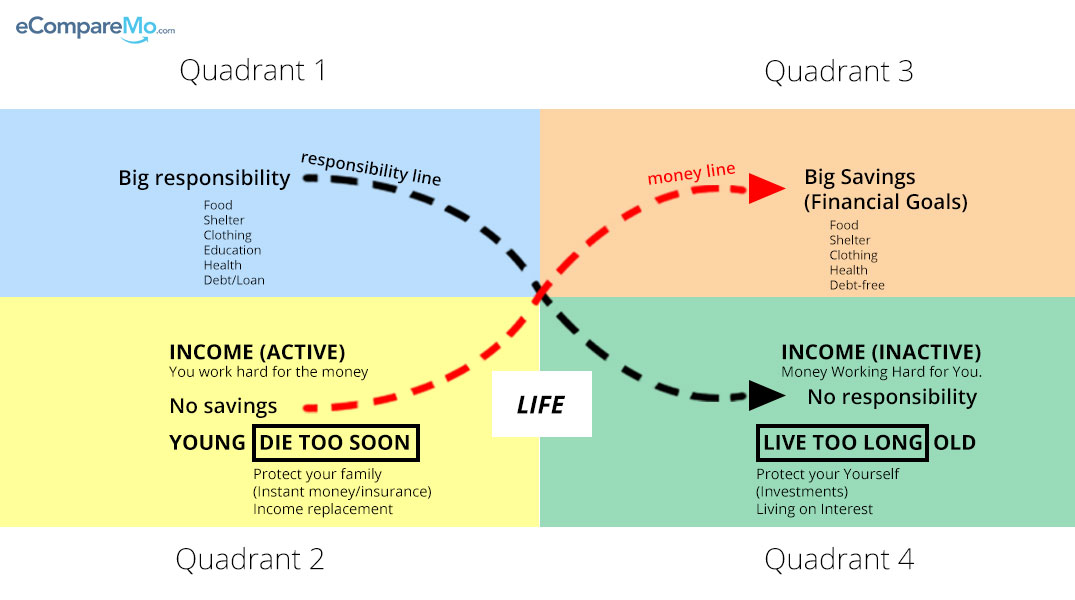

Debts and lack of security significantly affect one’s financial stability and directly impede the ability to save. Another financial planning tool that the book swears by is The X Curve Concept, which was propagated by the International Marketing Group.

“It teaches that we need to increase our money line as we grow old and have to move from depending on active income to passive income. It also tells us that we need insurance protection,†says the Santiago couple.

The need for long-term healthcare and retirement plan triggered the couple to apply the framework and prove its effectivity.

Understanding the X Curve

It’s ironic that you’re less secure financially while you’re young and able to make money. Using four quadrants, the X Curve makes us realize the importance of wealth building at this stage:

Quadrant 1. The younger you are, the higher your responsibility. However, income is temporary but necessities are permanent.

Quadrant 2. The younger you are, the more capable and expected you are to provide.

Quadrant 3. The goal is to accumulate enough wealth and make investments to be able to insure your future years especially your retirement.

Quadrant 4. With the right amount of knowledge on money management, you can live without worries and free from financial responsibilities because the money you invested is already working for you.

Benj and Fely say there are two life possibilities that directly affect financial realities: dying too soon and living too long.

“If we love our family, we must insure ourselves so when we die too soon, our loved ones will have instant money to live on,†they write.

They add: “In the event that we live a long life, we must love ourselves by having investments that will earn money so that we continue to live a good life in our retirement years.â€