How To Save Money Using Simple Mathematical Formulas

2 min readThese moneysaving strategies have been proven to work the world over. But not a lot of Filipinos are applying these in their budgeting and spending habits.

There are countless reasons you cannot keep a single centavo from going into a purchase. Lifestyle upgrades, living in the moment, and crippling debts are just some of them. Or maybe you set aside a portion of your money today and spend it tomorrow? Talk about being consistently inconsistent.

The truth is that a lot of us know for a fact that saving is an essential for survival, but, really, only a few people put their money where their mouth is.

If you are a novice at the art of saving money, here are some methods you might want to try to start building your wealth for the long term.

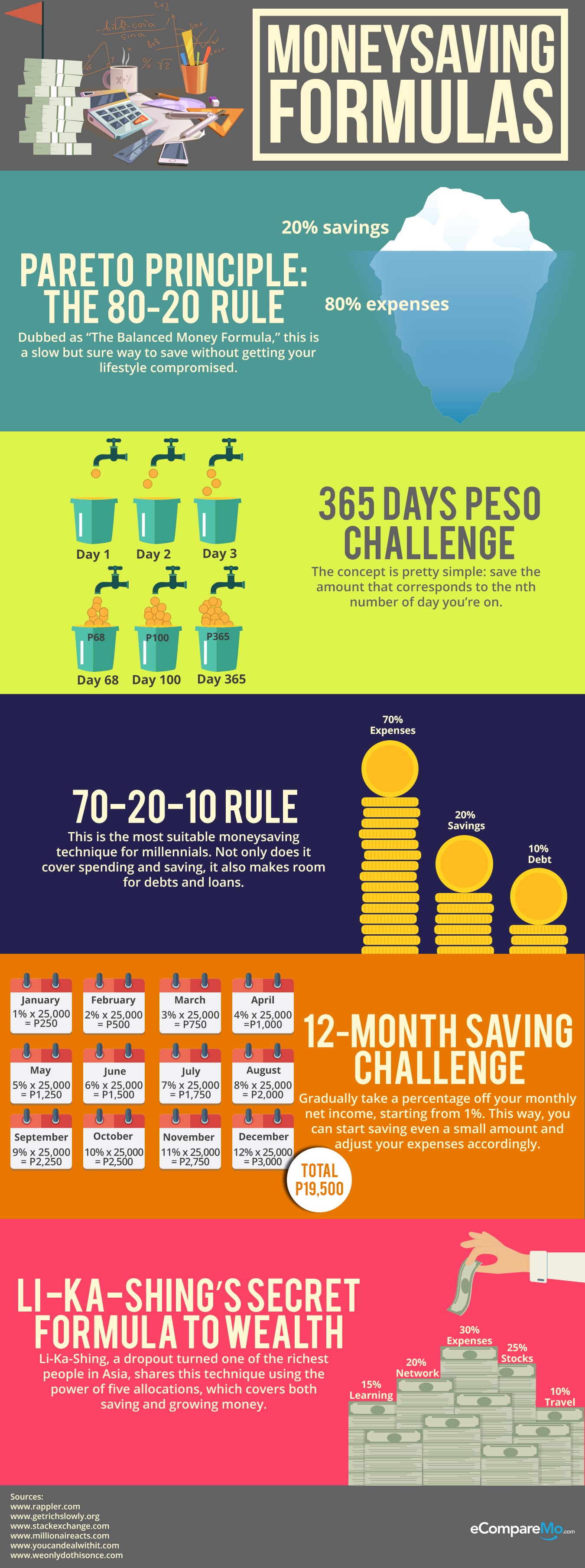

Pareto Principle: The 80-20 Rule

Dubbed as “The Balanced Money Formula,†the 80-20 Rule on money is the slow and sure way to save without compromising too much of your lifestyle.

20% of your net income goes to savings

80% goes to expenses (50% on needs and 30% on wants)

*If you have a P20,000 net income, for instance, you can spend P16,000 and save P4,000.

365 Days Peso Challenge

Take the guesswork out of saving. For this one, all you’ll need is a calendar and a reminder. This concept is pretty simple: save the amount depending on the nth number of day you’re on, and get realistic results.

Day 1 = P1 peso

Day 2 = P2 pesos

Day 3 = P3 pesos

Day 4 = P4 pesos

Day 5 = P5 pesos

…and so on

*1+2+3+4+ = …365 days will get you a total amount of P66,795 at the end of the year.

70-20-10 Rule

The budgeting method that best suits millennials. Not only does it cover spending and saving, it also makes room for debts and loans.

70% goes to cost of living

20% goes to savings (10% for retirement/insurance; 5% emergency fund; 5% for travel goals/tech purchases)

10% goes to credit card payment and loans

12-Month Saving Challenge

In this saving method, you gradually taking a percentage off your monthly net income starting from one percent. This way, you can start saving even a small amount and adjust your expenses and lifestyle accordingly.

January          1% x P25,000 = P250

February         2% x P25,000 = P500

March        3% x P25,000 = P750

April         4% x P25,000 = P1,000

May          5% x P25,000 = P1,250

June          6% x P25,000 = P1,500

July           7% x P25,000 = P1,750

August        8% x P25,000 = P2,000

September     9% x P25,000 = P2,250

October       10% x P25,000 = P2,500

November       11% x P25,000 = 2,750

December        12% x P25,000 = P3,000

Total          P19,500

Li Ka-Shing’s Secret Formula to Wealth

Imagine how a school dropout turned himself into the richest man in Asia. Li Ka-Shing shares his technique using the power of five allocations covering both saving and growing money.

30% on living expenses

20% on expanding your network

25% on investing in stocks, mutual funds, etc.

15% on investing in yourself and learning (buying books, attending seminars etc.)

10% on travel