All Your Questions About BIR Form 2316, Answered

6 min readTax season in the Philippines falls in the first quarter of the year. Around this time, Filipino employees are required by the Bureau of Internal Revenue (BIR) to file BIR Form 2316 or the Certificate of Compensation Payment or Income Tax Withheld.

If you’re employed, you are under an obligation to file your taxes. Luckily, most companies take care of filing their employees Form 2316.

For those adulting, or who want to understand this more clearly, we broke down all the important points in understanding the BIR Form 2316.

Read more on how it’s filed, its purposes, as well as the BIR Form 2316 Frequently Asked Questions.

What is in your BIR Form 2316?

The BIR Form 2316 tax filing follows the BIR’s definition of “compensation.” These are “salaries, wages and other forms or remuneration by each employer.â€

It shows the total annual salary of the employee and the taxes filed within the year, thus the terms “Certificate of Compensation Payment’ and ‘Income Tax Withheld.”

This form needs to be processed annually by the taxpayer. However, the BIR Form 2316 process is filed by the employers, as they are responsible for the ‘substituted filing’ on behalf of the employees. The employees are then issued their original and duplicate copies of Form 2316 on or before January 31st of every year.

The exception applies to those who have left the company. Employees who left the company, whether resigned or terminated, will receive their Form 2316 at the same time as their separation pay.

It is every employee’s right to receive the Form 2316. It is an important document not limited to employment and tax filing, but for other purposes outside of work, too.

February 28th is the deadline for the filing of Form 2316. Everyone needs to remember this, as the employer’s failure to submit or pay the tax/es due on behalf of employees is a criminal

(Read: List of Mandatory Employee Benefits In The Philippines)

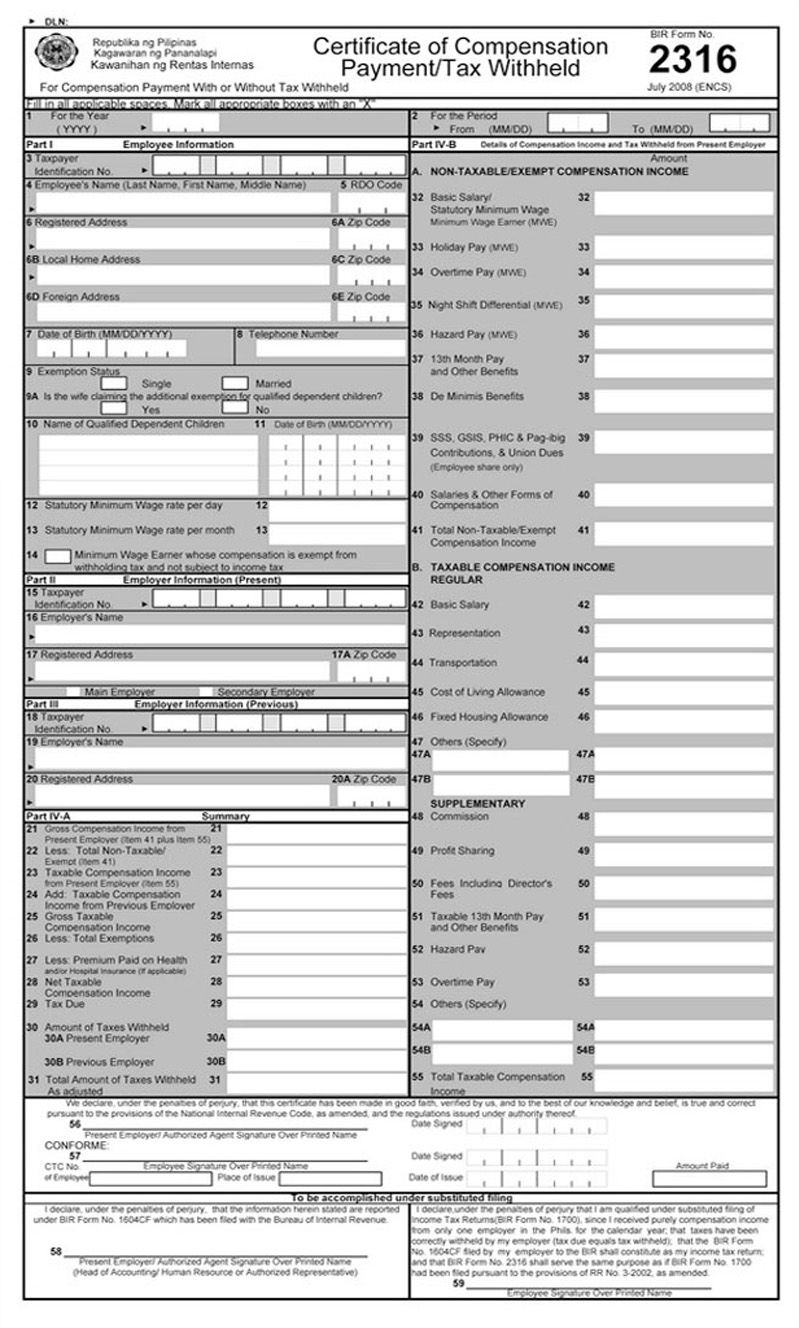

This is what your BIR Form 2316 looks like. As indicated by RR No. 11-2018, “The Certificate shall indicate the following information

a. Name and address of the employee

b. Employee’s Taxpayer Identification Number (TIN)

c. Name and Address of the Employer

d. Employer’s TIN

e. The sum of compensation paid, including the non-taxable benefits

f. The amount of statutory minimum wage received if

g. Overtime pay, holiday pay, night shift differential pay, and hazard pay received if employee is MWE

h. The amount of tax due, if any;

The form must be signed by both the employer and employee over printed name.

BIR Form 2316 Frequently Asked Questions (FAQs)

What if the employer forgets to file my Form 2316 for me?

The employers are mandated by law to file your Form 2316 for you. They should follow the dates specified by BIR. Your BIR FORM 2316 original and/or photocopy should be given to you on or before January 31st of every year.

“Failure of the employer to furnish the employee of the Certificate of Compensation and Tax Withheld shall be a ground for the mandatory audit of payor’s all internal revenue tax liabilities upon verified complaint),†states stated by BIR Revenue Regulations RR 11-2018 SECTION 12. Section 2.83.1.

Why should I keep my BIR Form 2316?

Keeping this form is more than the obligation and proof of filing and signing the withholding tax certificate. It extends to many very important “adulting†processes, such as the following:

• Bank applications

Your Form 2316 will serve as one of the “proof of income,” an important requirement when applying for

• Travel/Visa Applications

This form is just one of the solid documents needed in Visa applications, to prove the consuls that you won’t be overstaying in another country.

As the BIR Form 2316 is your proof of payment of tax, this shows that you are a regular taxpayer, something that is very important to show your rootedness in the Philippines. Consuls look at your ties to the Philippines to decide whether or not to issue you a visa.

Submitting your most recent BIR Form 2316 also allows consuls to see just how much you’re really earning. This will help prove to them that you have the budget to travel to their country and money to spend while you are there. It also serves as proof that you are established in the Philippines.

• Requirements for other government and private agencies

One example of a time when you will need to present your BIR Form 2316, is when you are transferring to another job. They will most likely require you to submit your latest tax certificate.

Some financial institutions will also ask to see your Form 2316 as proof of both identity and income. If you are opening a bank account or applying for a loan or credit card, this could be one of the required documents that you will need to present.

What happens if my employer has not filed my income tax for me?

Your employer is required by law to file your income tax before the given deadline of February 28 every year. Failure to do so is against the law and is subject to penalties.

If you believe that your employer is not filing your income tax or that there is something wrong with your form, you should report them to the following BIR hotlines:

• For questions on taxes and filing: BIR Public Information and Education Division Direct Lines: 981-7250; 981-7251; 981-7252

• For questions related to employer BIR violations and other tax concerns: Customer Assistance Division (CAD), formerly BIR Contact Center at: 981-7003; 981-7020; 981-7030; 981-7040; 981-7046

(Read: Tax Reform 2018: When Can You Expect The Changes To Happen?)

What are the BIR Form 2316 late filing violations and penalties?

The penalties for late filing are detailed on the BIR website. For general information, these are the BIR Form 2316 late filing violations and penalties, divided in two:

• Tax Returns with Tax Due

This means that the employer was not able to remit or withhold the tax of an employer. The penalty is a 25% fine on the amount of tax due, and the following terms as shown on the BIR government website:

NIRC SEC. 248. – Civil Penalties.

- There shall be imposed, in addition to the tax required to be paid, a penalty equivalent to 25% of the amount due, in the following cases:

(1) Failure to file any return and pay the tax due thereon as required under the provisions of this Code or rules and regulations on the date prescribed; or

(2) Unless otherwise authorized by the Commissioner, filing a return with an internal revenue officer other than those with whom the return is required to be filed; or

(3) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or

(4) Failure to pay the full or part of the amount of tax shown on any return required to be filed under the provisions of this Code or rules and regulations, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment.

- Interest of 20% per year on the unpaid tax amount

- Compromise

A fine of not less than P10,000 and no more than P20,000 upon conviction for anyone who, “attempts to make it appear for any reason that he or another has in fact filed a return or statement, or actually files a return or statement and subsequently withdraws the same return or statement after securing the official receiving seal or stamp of receipt of internal revenue office wherein the same was actually filed.â€

• Tax Returns with NO Tax Due

A compromised penalty will be applied for this violation, as shown on the table under Annex A of RMO No. 7-2015.

In addition, employees who were found with “Failure to File Certain Information Returns” will have to pay P1,000 for each failure, as long as the violation payments have not exceeded P25,000.

More details on violations and penalties for late filing of taxes are stated under the Penalties page of the BIR website.

Sources: Business Tips.ph, Lawphil.net, BIR, The Philippine Star