Know Your Credit Score in the Philippines

Measure your creditworthiness and discover how banks perceive you with our free tool

Get your free score

What is a credit score?

A credit score is a number that indicates your creditworthiness in the eyes of banks and financial institutions. A good credit score increases your chances to get approved for a credit card or loan.

Understand your value

Know your credit score and how that affects your pre-approval process.

Make better decisions

Get personalized recommendations for ways to use your credit more wisely.

Increase your chances

Learn what affects your credit score and what you can do to improve it.

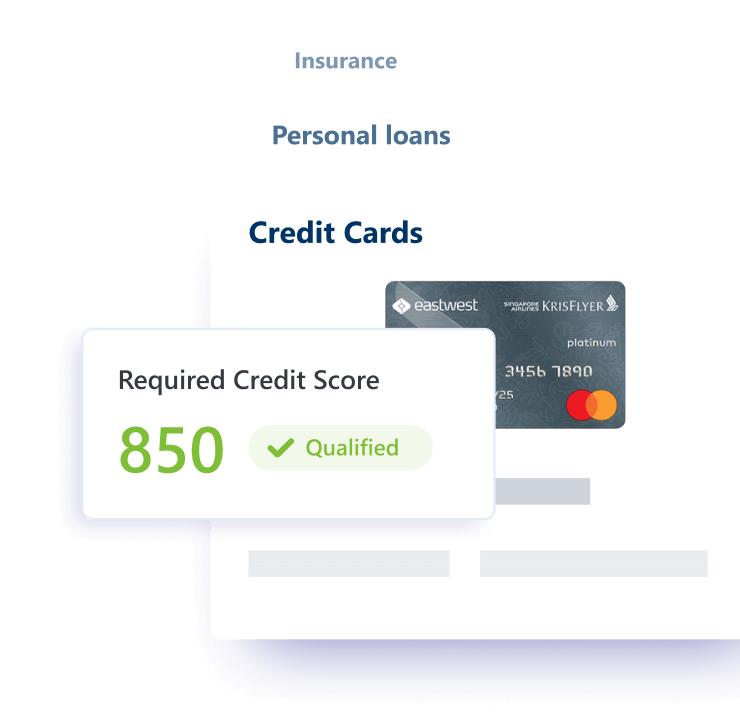

Personalized offers

Our credit score gives you personalized offers for credit cards, loans, insurance and more that are specifically tailored for you and your economic profile.

Quicker pre-approval process

Your credit score is a rating system for financial institutions to evaluate how creditworthiness you are to get approved for a credit card or loan.

Your credit score matters

Your credit score can determine how likely you are to be approved for a loan or credit card. It also gives you the freedom to shop around with banks and lenders for a better offers.

Speed up the process

A credit score can also help you speed up the process it takes for banks to evaluate your creditworthness. Your personal data like occupation and financial status are store with your score and it can help to reduce the time it takes to fill in long and painstaking application forms.

Credit scoring helps you

Having a good credit score is important when you are negotiating better rates on a loan or credit card. Your credit score can also influence your chances to succed when you apply for financial help or services.

Lower credit risk

A credit score can estimate your level of future credit risk, or how likely you are to repay a credit loan on time. By understanding your financial status and creditworthiness, banks and lenders can give you better services, higher credit and approve you quicker.

A credit score is a specific number that indicates whether an individual is a good or bad creditor. Banks and financial institutions use a person's credit score to gauge if they are worthy of being granted a loan or approved for a credit card.

A person changest their credit history every time they borrow money through a financial institution, as well as when they hit or miss their bills payments. The data being logged includes one's personal information, employment history, loan or credit amount, missed payments, and complete debt/s settlement.

Credit Scores are usually applied by banking companies, which are indicated by the numbers 550 to 1100. So, if you have a credit score above 720, that means you are in the criteria for a good and safe customer. In essence, the higher your credit score, the better your chances of getting approved for the next loan. Moreover, your credit score can affect your chances of getting applications such as:

- Credit card

- Loans (Unsecured Loans, or with Collateral)

- Purchase a car

- Property purchase

- Insurance monthly payments, and other

Your credit score may seem like a mere numeric representation. But if you look closer, it has a powerful effect on your financial future. These factors may affect your credit score in the Philippines:

- Credit payment history

- Utilization ratio

- Length of credit history

- Closing old cards

- Types of credit card used

- Credit inquiries

- Negative information

- A sudden increase in your debit/credit ratio

- Your employment history

- Your monthly utility bills

Know more about the things that go into your credit score in this infographic.

Having a good credit score always translates earning the trust of banks and financial institutions you are dealing with.

A negative credit history may greatly affect your chance of getting approved for a personal loan or credit card, and eventually--just when you need it most--a housing loan. Having a high credit score opens the door to a lot of money-saving opportunities that can lead you to great savings and banking privileges.

Here are some tips on how you can establish a good credit score in the Philippines:

1. Pay your bills on time

Settle your dues on or before the due date and, as much as possible, pay in full. Making a minimum payment may not only prove to be damaging to your score, there's a danger your debts will continue to pile up in the future.

2. Set up an Auto Debit Bill payment system

Late payment is tantamount to missing a payment. With an auto debit system, you can schedule your payments on a payday. So, you stay safe and don't make you late to pay bills.

3. Avoid consecutive loan applications

Did you just apply for a loan? Ideally, you should wait for at least six months to a year before you apply for another one. Show creditors that you can pay your bills smoothly, without delay, so that your next loan application may be approved quickly.

4. Use your credit cards actively and diligently

Did you know that a credit card can be a way to increase your credit score quickly? That is, if you use it frequiently and wisely. Take advantage of cashbacks, airmiles, points, and other promos, and pay your credit card bill on time.

5. Settle outstanding debts

It is of utmost importance to settle all your outstanding debts. Mounting debts lead to a negative credit history, which will make it difficult for you to get approved for a financial product.

6. Have fixed stream/s of income and assets

It is always a good thing steady income and own appreciating assets. If you don't have enough income, it will be hard for you to pay your bills, and this affects your credit score.