President Xi Jinping’s Philippine Visit: 4 PH-China Deals You Should Know About

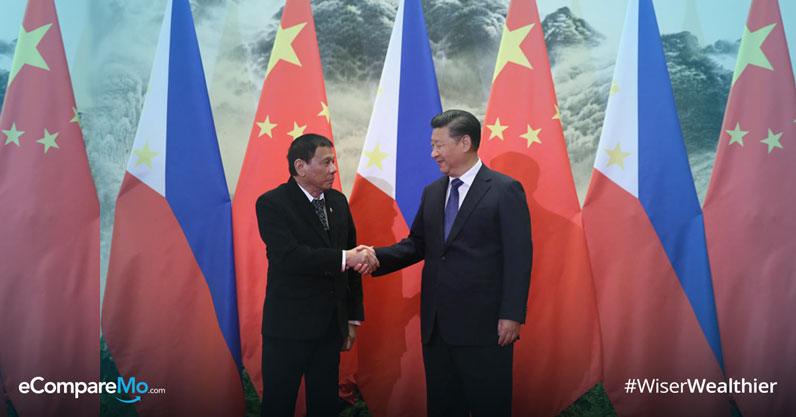

6 min readOn November 20, Chinese President Xi Jinping made an official state visit to the Philippines. President Rodrigo Duterte, who has already visited China thrice since he assumed office in 2016, welcomed his Chinese counterpart with much enthusiasm.

Apart from the pleasantries and other ceremonial deeds, the two leaders signed numerous deals that will supposedly benefit the Filipinos.

Due to the controversial penchant of the Duterte administration for Xi, people were up in arms on social media to criticize the overly welcoming stance taken toward the Chinese leader. Its hotly debatable nature caused pieces of misleading and erroneous information to be hurled all over social media.

While there was a total of 29 deals were signed between the two parties, we picked four to examine closer:

1. The joint exploration of the West Philippine Sea

Of all the deals signed by the two heads of states, this one probably takes the cake in terms of vehement opposition and controversy.

According to reports, the two leaders signed a memorandum of understanding (MOU) on the development of

Although no details were yet released by the government, Energy Secretary Alfonso Cusi said that the deal will be “an exploration to find a solution†for the country to take advantage of natural resources offered by the West Philippine Sea. In addition to vague details, parts of the contested water where the exploration will be conducted.

How will the Philippines benefit from this?

According to a report by Rappler, the MOU between the Philippines and China is a much “lower level of commitment†between two parties than a standard memorandum of agreement (MOA), where the basic outlines of the deal have already been defined.

There is no agreement yet between the two countries regarding the terms of the joint oil exploration. With the MOU, what they have is, according to Cusi, “memorandum of understanding to agree to arrive at an agreement.â€

Foreign Secretary Teodoro Locsin said that they would ask Beijing for permission first before they release copies of the deal. Let’s all wait until then.

2. The setup of the peso-yuan spot market

Last October, the Bank of China signed a deal with some of the Philippine banks to set up the Philippine RMB Trading Community, one of the many attempts of the Asian powerhouse to internationalize the use of the yuan. During Xi’s visit, the two governments finally laid out its plans on how the yuan will be used in the Philippines.

With the MOA on the peso-yuan exchange, businesses trading using the Chinese currency can finally convert their currency to peso or vice versa without the need to exchange them first to

“The Philippine RMB Trading Community aims at promoting the [peso-yuan] market and creating an end-to-end platform for the convenient and cost-effective conversion between pesos and RMB,†said the RMB Trading Community chairman Deng Jun in a report by BusinessWorld.

How will the Philippines benefit from this?

With the yuan fully embraced by the Philippine economy, it will be much easier for the currency to flow in the country. Local businesses can easily facilitate trade using either pesos or yuan. Even OFWs based in China will find it more convenient to send back their remittances.

The country is cutting out the middleman—which in this case has been solely the US dollar. However, it doesn’t mean that the US dollar will be supplanted by the Chinese currency as the choice for all foreign transactions. The exchange will just make it easier for the two Asian countries to trade.

In addition, Bangko Sentral ng Pilipinas Deputy Governor Chuchi Fonacier said that an alternative currency to the dollar will “definitely†make the peso less volatile because it isn’t exclusively tied to the American banknotes.

If you’re scared, don’t fret: Bear in mind that the yuan isn’t the only money being courted by the Philippines. A spot trading platform between the peso and the Japanese yen is also being sought by the government, according to Department of Finance Secretary Carlos Dominguez III.

3. The $2-billion investment in the New Clark City

Under the ambitious “Build Build Build†program of the Duterte administration, the government will spearhead numerous infrastructure projects that will supposedly lead the Philippines to a new golden age of infrastructure. One of the big-ticket projects under the program is the New Clark City in Capas, Tarlac, a 94.5-square kilometer space that will be designed to become a new center of commerce in the country.

Xi announced that a Chinese company will pour $2 billion (P105.2 billion) into the construction of an industrial park in the said community. According to reports, the China Gezhouba Group will create factories for Chinese technology and manufacturing firms to create their products here.

In a report by the Philippine Star, Gezhouba Group is just waiting for the Philippine government to give its green light to release the details.

How will the Philippines benefit from this?

Bases Conversion and Development Authority (BDCA) president Vivencio Dizon told the Financial Times that the industrial park in the New Clark City will give more jobs to Filipinos.

“It’s probably going to be one of the biggest Chinese investments in the country. You are talking about thousands of jobs that would be made available there once those industrial locators come in,†said Dizon.

In addition to the jobs that will be created once the industrial park has been completed, sectors such as construction will also greatly benefit

4. The memorandum of agreement for the issuance of Panda bonds

In line with the more widespread adaptation of the Chinese yuan as well as numerous projects by the Duterte administration, the government needs robust funding from both internal revenue and external sources. To get additional funding for the “Build Build Build†program, the government will sell “Panda†bonds to the Bank of China.

According to Secretary Dominguez, the two governments signed an MOU that will allow the multi-tranche bonds to be sold to the Bank of China.

Dominguez explained that the MOU will lay down the “general framework to facilitate cooperation between the DOF and the Chinese bank on future issuances by the Philippines of renminbi-denominated ‘panda’ bonds in the Chinese debt capital market.â€

Although no specifics were yet released, National Treasurer Rosalia V. De Leon said through a BusinessWorld report that the government is looking at three and five-year tenors for the yuan-denominated bonds. The sale of bonds will boost the government’s coffers to the tune of more than P45 billion.

How will the Philippines benefit from this?

Once the government has completed the sale of Panda bonds to the Bank of China, it will replenish the government’s funding, which will be instrumental to the big-ticket projects of the government. The Bank of China promised to purchase around P45 million worth of bonds.

With new money flowing to the Philippine treasury, government projects will finally get their green light. Once the infrastructure programs push through, they will provide jobs for Filipinos, especially those in the construction sector, and commerce will be positively affected by those efforts.

The Philippines, as the spending economy, will hopefully generate jobs, which in turn will increase private spending among its citizens.