How To Use UnionBank Online Banking: A Comprehensive Guide

7 min readThe Union Bank of the Philippines Inc., more popularly known as UnionBank, was established in 1968 as Union Savings and Mortgage Bank. In 1993, they merged with Interbank (International Corporate Bank) and merged again with iBank (International Exchange Bank) in 2006.

UnionBank was quoted by Finance Asia last 2009 as one of the ten companies in the Philippines with the “Best Corporate Governance,†“Best Corporate Social Responsibility,†and “Most Committed to a Strong Dividend Policy.â€

The bank also bagged 9th place out of 44 banks under BSP (Banko Sentral ng Pilipinas) with a total asset of 597,885.35 last Dec. 31, 2018.

Given their good standing with the business community, UnionBank is also trying to remain in good standing with their customers. One of their initiatives is constantly making big changes on their banking services, making it more convenient by allowing their customers to do many transactions online.

Most of their branches have also moved to paperless transactions, making them one of the most modern and convenient banks in the Philippines to transact with.

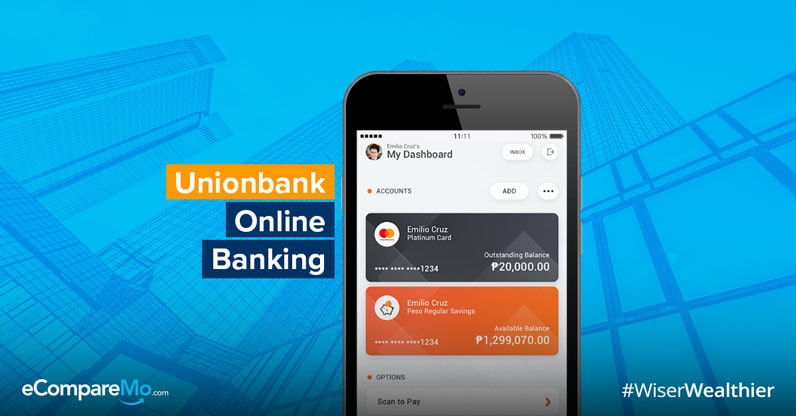

The UnionBank Online Banking App

With our busy schedule every day, who wants to run to the bank, wait in a long queue just to pay bills or check their accounts balance? Well, if you are a UnionBank customer, know that their online mobile banking app has features to make the life of their customers easier and hassle-free.

Basically, what online banking means is that most of the transactions can now be done on your phone or desktop. You no longer have to go to the bank for bills payment or bank transfers. So convenient, right?

UnionBank’s mobile banking app has these features to offer:

1. Funds transfer

Through funds transfer, you can easily send money to any of the major banks in the Philippines for free.

You don’t need to register or enroll the accounts you want to transfer to. All you have to do is indicate the account details, enter the amount you want to transfer and voilá, you’re good to go.

The daily transfer limit is P500,000 but this can be adjusted anytime. Just go to Setting>Transaction Limits, and enter the amount you prefer.

How do I transfer money using the UnionBank mobile banking app?

- Click “Transfer Funds” and choose where to transfer the money

- Choose the account you will get the fund from

- Indicate the details of the account you will be transferring to

- Type in the amount, frequency, and note details

- Check if all the details you entered are correct

- Click “Submit”

(Read: Top Mobile Banking Apps in the Philippines)

2. Pay bills online

You can now pay your bills or someone else’s bill online without any enrollment needed.

If you choose to pay your bills through the app, just look for the company in the list of billers, specify your account details, and pay. Easy as that!

There are over 150 billers in the Philippines. Keep in mind, though, that some billers change the account number or bill reference number every month. Make sure you double-check the details before clicking submit.

How do I pay my bills through the UnionBank mobile banking app?

- Click “Pay Bills” and “Select Biller”

- Choose from the list of billers provided

- Indicate the billers needed information

- Choose the account you will pay from

- Check if all the details you entered are correct

- Click “Submit”

3. E-load purchase

Through the UnionBank mobile banking app, you may purchase e-load from Globe (P15 to P150), Smart (P15 to P500), Talk ‘N Text (P15 to P500) and Sun Cellular (P25 to P450) online.

You can also send the load you bought to other people. Just indicate the mobile number of the person you will be sending the e-load to and click send.

How do I buy load using the UnionBank mobile banking app?

- Click “Buy Load” then enter the mobile number

- Choose the account you will pay from

- Choose the amount of load you will buy

- Check if all the details you entered are correct

- Click “Submit”

(Read: Brace Yourselves: ATM Interbank Charge Fees Could Go 50% Higher)

4. Edit your personal information

The app is also designed like our social media accounts where you can use your favorite photo, update your personal information, and get notifications, just like in any other app.

How do I edit my profile in the UnionBank mobile banking app?

- Click “More” then select “Settings”

- Click “Profile”

- Update your profile picture and information

- Click “Save”

5. View your accounts online

UnionBank online banking allows you to check all your card’s balances online! Just tap and swipe your account details and swipe across for deposit accounts, loans, and credit cards.

6. Log in using your fingerprint

You can now use your fingerprint to secure and access your accounts. Make sure that the only fingerprint registered on your phone is yours or else others can easily access your bank details.

How do I register my fingerprint in the UnionBank mobile banking app?

- When you are signing up, enable the Fingerprint Authentication

- Another option is to go to “Settings”

- Click “Login and Security”

- Enable Fingerprint

(Read: The Ultimate List Of Easy-To-Do Anti-Fraud Tips)

How do I sign up for UnionBank’s mobile banking app?

Download the UnionBank Online app at the Play Store. It will ask you to login your user ID and password. If you don’t have an account yet, you can sign up by using your ATM, Account No., Credit Card, or Loan account.

1. ATM

- Click the “Sign Up” button

- Click “ATM Card”

- Enter your card number and pin

- Type in your ONE-TIME PASSWORD

- Create your UnionBank online profile and fill up the needed information

2. Account Number

- Click the “Sign Up” button

- Click “Account Number”

- Enter your account number

- Type in your ONE-TIME PASSWORD

- Create your UnionBank online profile and fill up the needed information

3. Credit Card

- Click the “Sign Up” button

- Click “Credit Card”

- Enter your card number

- Type in your ONE-TIME PASSWORD

- Create your UnionBank online profile and fill up the needed information

4. Loan

- Click the “Sign Up” button

- Click “Loan”

- Enter your loan account number

- Type in your ONE-TIME PASSWORD

- Create your UnionBank online profile and fill up the needed information

(Read: Bangko Sentral: Banks Must Provide Customers With Interbank Fund Transfer Channels)

Advantages and disadvantages of online banking

Advantages

- Convenience

Let’s be real for a minute. Let’s pretend that you are in a really bad mood, okay? You’re on your way home but forgot that you need to deposit to your sister’s account for her tuition. When you get to the bank, the line is long and it seems the staff is working extra slow.

What a nightmare, right? But through online banking, you don’t have to wait for hours in line to transfer money. You can do it in less than five minutes through your phone anywhere. Just pull out your phone, open your UnionBank Online banking app and enter the details needed to for the transaction, then you are good to go!

You can manage your financial accounts and transactions online as long as you have access to the internet. Though sometimes there can be glitches, so don’t expect online banking to be perfect.

- Eco-friendly

Paper bank receipts, bills and other documents when it comes to bank transactions are one of the major reasons why we have so much clutter.

Have you ever seen an ATM machine where all the receipts are just thrown at the ground because the garbage can is already full? Through online banking we can reduce our paper usage and help the environment!

- Lower fees

Compared to traditional banking, there are fewer charges when using the mobile banking app.

- Accessible anytime

Through online banking, you can pay online, transfer money and more 24/7! You don’t have to wait until the bank is open on a regular day or even after a holiday. Everything is accessible to you as long as they are not doing maintenance routines that day.

(Read: On Paperless Billing: Should You Pay Your Service Provider For Printed Billing Statements?)

Disadvantages

- Physical customer service

If you are having problems with your account, most of the time you won’t be able to resolve it via the internet or even when you call customer service. You have to go to the bank itself.

- No internet, no service

Not everyone has internet data or pocket WIFI with them. You won’t be able to access your account or do any transactions if you don’t have internet!

(Read: Everything You Need To Know About Credit Card Two Factor Authentication)

Safety tips for online banking

- Always change your password every one to two weeks

- Be smart when opening emails/links that pop up on your screen every once in a while

- Do not use your mobile banking app if you are in a public place

- Make sure your device has passwords that will keep your personal information safe

- NEVER open or enter your personal information if it is not in the bank’s app

For inquiries, you may contact their 24-Hour Customer Service:

Metro Manila (+632) 841-8600

PLDT domestic toll-free calls 1-800-1888-2277

International toll-free calls (IAC) + 800-8277-2273

Email customer.service@unionbankph.com

You may also contact the BSP-Financial Consumer Protection Department (FCPD) at (02) 708-7087 or consumeraffairs@bsp.gov.ph