This Step-By-Step Guide To Creating A Budget List Will Make You Smarter With Money

2 min readEveryone can create a budget, but it takes a different set of skills to create a monthly budget that packs a punch yet offers flexibility for unexpected situations. If making a monthly budget is a bit hard for you, then you might want to follow these steps in creating a monthly budget, beginner style.

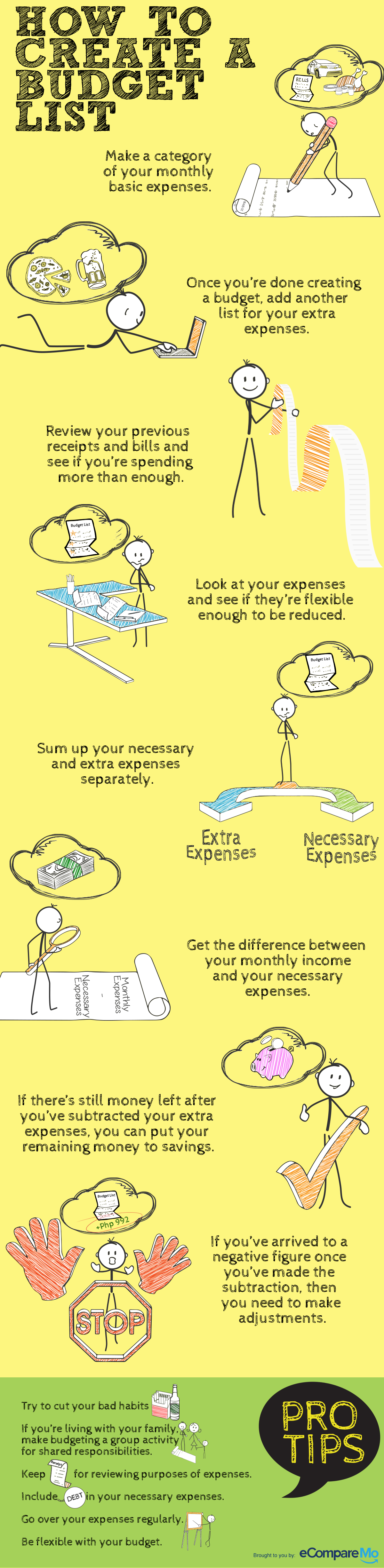

- Make a category of your monthly basic expenses. Protip: when categorizing your expenses, start off with bigger ones (food, transportation, debts) before you break them down further.

- Once you’re done creating a budget, add another list for your extra expenses. Protip: set a limited budget for your extra expenses and plan ahead what items you need to get (pizza weekend, social gatherings, etc.)

- Review your previous receipts and bills and see if you’re spending more than enough. Protip: if you have kept your receipts over the past few months, create an average and see if you’ve exceeded the average.

- Look at your expenses and see if they’re flexible enough to be reduced. Protip: mark those categories with a star if you think they can still have a flexible budget.

- Sum up your necessary and extra expenses separately. Protip: by creating a distinction between the two, you can have a buffer for your necessary expenses in the form of your extra budget.

- Get the difference between your monthly income and your necessary expenses. Protip: once you’ve subtracted the two, you now have your budget for your extra expenses.

- If there’s still money left after you’ve subtracted your extra expenses, you can put your remaining money to savings. Protip: put your money in a savings account so you can see your money grow over time and to prevent you from spending it.

- If you’ve arrived to a negative figure once you’ve made the subtraction, then you need to make adjustments. Protip: while it is tempting to minimize your basic expenses just to make sure you get out of a negative difference, use your budget for extra expenses to compensate for your deficit.

Check out: (Family Bonding Ideas That Won’t Hurt Your Budget)

Other protips that will come in handy when budgeting:

- Try to cut your bad habits like alcohol and tobacco from your expenses; you’ll have a bigger room for bigger and more important expenses when you’ve kicked the habits.

- If you’re living with your family, make budgeting a group activity to even out the responsibility.

- Keep your receipts as much as possible or if you can’t get the receipt, list down your expenses for that day and store them in a single file box for reviewing purposes.

- Be sure to include debts in your necessary expenses. Once you’ve been able to settle them for good, you will have more money for savings, necessary, and extra expenses.

- Go over your expenses regularly. When you review your expenses every now and then, you can see if there are trends you need to watch out—and you can deal with them accordingly next month.

- Be flexible with your budget. Watch out for potential expenses that can rock your monthly budget. Learn how to adjust your budget depending on the situation.