PhilHealth OFW Contribution Hike: What You Need To Know

6 min readIn April 2020, the Philippine Health Insurance Corporation (PhilHealth) issued a circular detailing premium adjustment for overseas Filipino workers (OFW), which was met with strong opposition and widespread criticism.

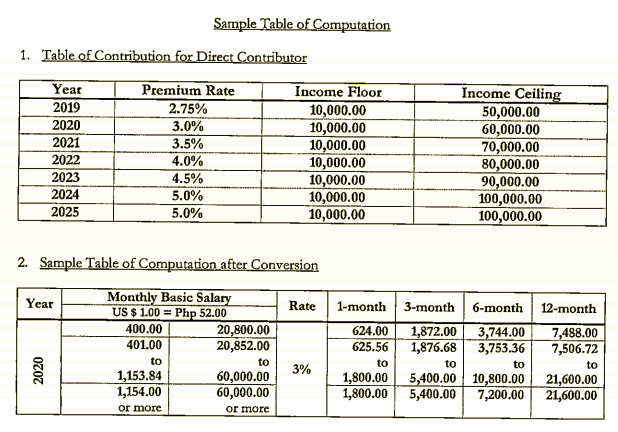

The PhilHealth OFW contribution hike is according to Circular No. 2020-0014 dated April 16, which says premiums billed on overseas workers will incrementally increase from 2020 to 2025. Last year, OFWs were required to remit around 2.75 percent of their salaries of up to ₱50,000 to the state insurance company.

While the company explained that it is in accordance with the Universal Health Care (UHC) Act, which was certified urgent by President Rodrigo Duterte and eventually signed into law last year, citizens slammed the move, saying that the increase happened at the most insensitive time of the year.

As of writing, PhilHealth President and CEO Ricardo Morales said that the agency will suspend the implementation of the hike, stating in an interview that the deadline will be “extended for the pandemic period.â€

“May moratorium tayo sa collection. Obviously, paano kokolektahin iyon kung walang suweldo ang tao,†said Morales in a report by Rappler.

Meanwhile, President Duterte also backed the suspension of higher premium collection from OFWs. According to Presidential Spokesperson Harry Roque, the President ordered the suspension of the premium hike as part of relief for OFWs, especially the ones who were repatriated due to the COVID-19 pandemic.

With parties involved with law denouncing their involvement with the PhilHealth OFW contribution hike—not to mention that parties spreading malicious information about the policy—it’s time we know the truth about the PhilHealth contribution hike for OFWs.

What is the issue all about?

- The latest PhilHealth circular’s goal is to clarify the implementation of the contribution hike for OFWs, summarized into these points:

- PhilHealth defined OFWs as the following Filipinos: land-based workers, seafarers and other sea-based workers, Filipinos with dual citizenship, Filipinos living abroad, overseas Filipinos in distress, other overseas Filipinos not previously classified elsewhere. Before the UHC, membership was optional for migrant workers.

- In addition to a wide definition of OFWs, PhilHealth reiterated that the UHC Act considers them as direct contributors, which is part of the implementing rules and regulations of the law signed by Department of Health Secretary Francisco Duque.

- Premiums from 2019 to 2020 will only increase from 2.75 percent to 3 percent. However, all direct contributors will see a 0.5 percent increase in their premium rate from 2021 to 2024, with the yearly rate hike stopping at 5 percent.

- In addition to the increase in premium rates, income ceiling will also go up from P50,000 last year with a P10,000 annual increase. By 2024, the income cap for calculating contributions will be P100,000. Both the premium rate and income ceiling were indicated in the UHC IRR.

- Overseas Filipinos who will not pay their contributions will receive a penalty that requires them to pay all the contributions they missed with compounding interest.

Why do people consider the OFW PhilHealth contribution hike unfair?

The hike is considered unfair by critics for a lot of reasons such as:

PhilHealth broadened the scope of migrant workers mandated to pay contributions to include Filipinos already residing in another country, dual citizens, and overseas Filipinos in distress. To make sure that every Filipino outside the country is included, they added “other overseas Filipinos not previously classified elsewhere†to the circular, which is too vague and broad.

Unlike local employees where half of their state health insurance premiums are shouldered by their employers, OFWs cannot mandate their employees to do the same. This means that they have to cover the entire cost alone.

Unpaid premiums to PhilHealth will accumulate a compounding interest if unpaid.

Increase in both premium rate and income ceiling will mean that contributions for high-income earners will go up exponentially. For instance, an OFW with an income of P100,000 who used to pay P1,375 per month (2.75 percent rate, income ceiling P50,000) will be paying P5,000 by 2024. This translates to around 263 percent increase over five years.

While Filipinos, especially overseas workers, are angry with this new PhilHealth contribution policy, there were also pieces of false information circulating such as travel ban for OFW who fail to pay their premiums. This information is false and is not mentioned in any official document such as the circular, the UHC act, or the IRR by the DOH.

Who should we blame for this kerfuffle?

As expected, the people involved with both the UHC and the PhilHealth contributions hike are trying to shift the blame from one another. However, there is no singular person or entity to blame for this whole thing.

Roque said the UHC law did not state anything about the new schedule of contributions for the state insurance, stating that the specifics of the health insurance law are within the IRR published by PhilHealth. Roque served as one of the principal authors of the UHC when he was still a lawmaker.

The UHC IRR, which laid out the concrete plans of the government in implementing the state health insurance act, fell under the responsibility of both the DOH and PhilHealth. For the UHC, it was created by both agencies with Duque signing it as both the health secretary and board member of the PhilHealth.

Other frequently asked questions about the OFW PhilHealth contribution hike

What is the new schedule of PhilHealth premium payments under the UHC law?

Paying members must follow this table for their PhilHealth payments:

Keep in mind that this applies to all members considered as direct contributors, including formally employed Filipinos, self-employed individuals, overseas Filipino workers, professional practitioners, and lifetime members.

How can OFWs calculate their monthly contributions?

Using the schedule published by PhilHealth for all direct contributors, OFWs can determine their premiums. Keep in mind that the premium rate and income ceiling changes every year.

For instance, a person earning P100,000 per month must P1,800 per month for this tranche of the rate hike, translating to P21,600 in premium payments every year. This is based on the prevailing rate for the year, which is 3 percent of the monthly salary with an income cap of P60,000.

In 2021, the monthly premium for the same salary will be P2,450 (3.5 percent premium rate, P70,000 income ceiling), P2,800 in 2022 (4 percent premium rate, P80,000 income ceiling), P4,050 in 2023 (4.5 percent premium rate, P90,000 income ceiling), and P5,000 in 2024 and beyond (5 percent premium rate, P100,000 income ceiling).

How will OFWs get the peso conversion rate of their premiums?

According to the circular, the amount in peso will be based on the exchange rate bulletin of the Bangko Sentral ng Pilipinas, which you can find on their website. For currencies not included in the bulletin, the amount will be converted into US dollar first before translating it to Philippine peso.

What is the payment term for OFW contributions?

The payment scheme for OFWs will be divided into two periods: the transition period this year and the start of the new contribution terms in 2020. For this year, land-based OFWs can opt to pay a minimum of P2,400 and settle the rest of their premiums within the year.

Starting next year, they must pay a minimum of three months’ worth of premiums as an initial contribution and settle the rest through quarterly payments or one full payment.

How can OFWs pay their PhilHealth contributions?

For land-based OFWs, payment is possible through all the authorized channels. Meanwhile, sea-based OFWs who have a contract with a company here will see their premiums deducted monthly from their salary.

What happens if an OFW misses payments of their premiums?

Since every OFW is tied to a certain PhilHealth account, it will be easy for the government to keep track of their missed payments. The agency will then mandate them to pay the premium with compounded interest.

How can they prove their monthly salary?

Land-based articles must submit the following documents to PhilHealth:

- Overseas employment contract

- Overseas employment certificate issued by the Philippine Overseas Employment Agency

- Certificate of employment with income

- Payslip

- Other documents supporting a person’s income accepted by PhilHealth

For seafarers and other sea-based workers, the following must be presented:

- Certificate from manning agency

- Filipinos living abroad and dual citizens/passport holders must present the following proof of income:

- Income tax return

- Notarized affidavit of income declaration

- Other documents supporting a person’s income accepted by PhilHealth