Make It Till Payday With This Petsa de Peligro Survival Guide

3 min readPayday is the most anticipated day of the month for employees since it usually means worries over credit card balances and other bills are finally over. Pinoys typically spend their cash on karaoke or buckets of beer with co-workers upon payout. Some go out to see a movie, order fancy dinner, or purchase a long-awaited item as a well-deserved reward after a month of commuting and long work hours.

Read:Â (4 Pay Day Habits You Need To Avoid ASAP!)

Signs To Watch Out For

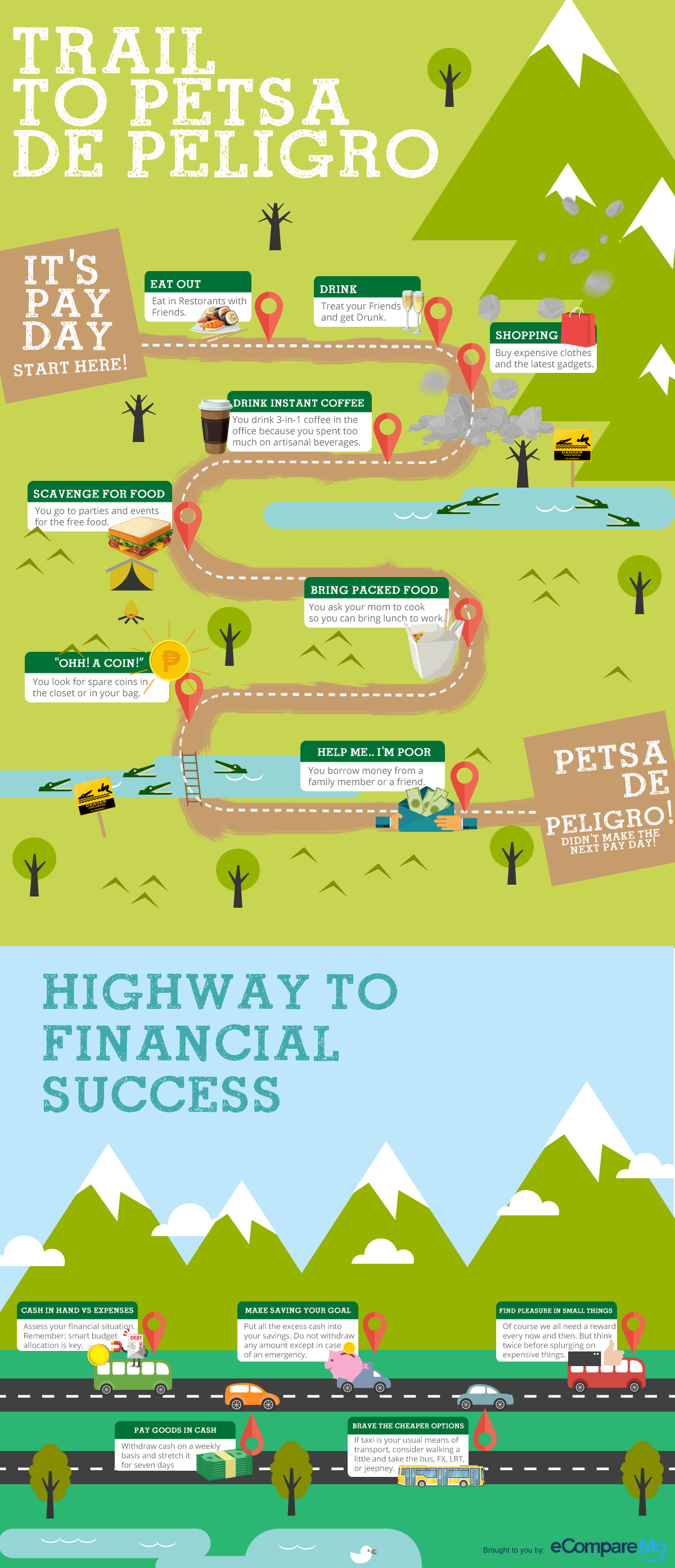

However, you gratify yourself, being a one-day millionaire is sure to result in the so-called ‘Petsa de Peligro’. This is when your budget cannot make it to the next payday. Here are some typical scenarios when your budget is within the ‘danger days’ zone:

- You go to parties and events for the free food.

- You drink 3-in-1 coffee in the office because you spent too much on artisanal beverages.

- You ask your mom to cook so you can bring lunch to work.

- You don’t turn the air conditioner on anymore to lower your electricity bill.

- You pretend you are fasting or on a diet.

- You look for spare coins in the closet or in your bag.

- You borrow money from a family member or a friend.

Read: (Is Learning Financial Literacy Lessons Possible With Credit Cards?)

What You Need: Budget Makeover

Petsa de Peligro happens at some point in one’s professional life. This is due to overspending or unexpected expenses like sickness or an accident. If you always find yourself in a financial crisis, you have to fix this repeating money emergency ASAP. Here are some hacks to make your money last until the next payday:

- Cash in hand vs Expenditure. Assess your financial situation. Remember: smart budget allocation is key. Your spending habits should fit the amount of money you are earning. Plot your expenses using MS Excel or your mobile calendar for easy monitoring. Here is a sample breakdown: DAILY EXPENSES: Food and transportation allowances

MONTHLY EXPENSES: Rent, communication allowance, water, and electricity bills

VARIABLE EXPENSES: Leisure and clothing allowances, cable bill - Pay goods in cash. Refrain from swiping your card whether debit or credit. Withdraw cash on a weekly basis and stretch it for seven days. Seeing your remaining cash at hand run out will hinder you from overspending.

- Make saving your goal. Apply for a savings account or a time deposit account. After you compute all your expenses, put all the excess cash into your savings. Do not withdraw any amount except in the case of an emergency. The good old piggy bank can also do the trick. Collecting loose change can buy you something later on. Investing in health insurance is also a way of saving as this ensures that your money is spent on securing your future.

- Brave the cheaper options. If the taxi is your usual means of transport, consider walking a little and take the bus, FX, LRT, or jeepney. If you have your own car, take public transport at least twice a week to cut down on gas expenses. Buy food at a jolly jeep or a cafeteria instead of eating every day in expensive restaurants or fast food chains. For clothes and other items, opt for surplus shops or wait for month-end discount promos. Always go for what is cost-effective.

- Find pleasure in small things. Of course, we all need a reward every now and then. But think twice before splurging on expensive things. Ask yourself first: Is this item worth it? Is it going to be beneficial in the long run? Learn the art of contentment. You can always reward yourself with simple things like a slice of your favorite cake or an hour of full body massage.

Read: (Want To Increase Your Savings? Try Giving Up These Habits For Lent)

Following these steps will help you steer clear from unwanted debt and save you from having Prada-to-nada days. Petsa de Peligro is definitely avoidable if you plan your budget accordingly and stick to it consistently.

Do you have your own technique of surviving Petsa de Peligro? Share it on the comment box below!